BHP Gives Away Potential Global Scale Nickel Project – Tiny Company Drilling Now

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

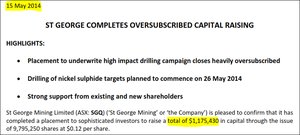

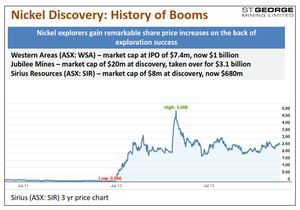

The discovery of a brand new mining province. It’s what all investors, including ourselves, dream of. We have been alerted to a company hoping to discover a brand new Australian nickel province . We all know about Sirius Resources and the Fraser Range – Sirius had a market cap of $8 million at the time of their Nova Bollinger discoveries – now it’s worth $680 million. But maybe you had forgotten about the nickel discovery of Western Areas – they had a market cap of $7.4 million at IPO – now they are worth $1 billion. Jubilee Mines had a market cap of $20 million at the time of their nickel discovery. In the years to follow they grew into a multi-billion dollar company – then they were taken over for more than $3 billion . The past performance of these products are not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. These products, like all other financial products, are subject to market forces and unpredictable events that may adversely affect future performance. Back in the Fraser Range, a cohort of explorers have since followed Sirius, looking to emulate the Nova-Bollinger discoveries. And we don’t blame them. Nearology is one way to go about it... but the other way is to do what Sirius did – make the first major discovery in virgin territory . That’s what the junior explorer we have added to our portfolio today is aiming to do... capped at under $12 million, it’s searching not for the next Nova, but for the next Fraser Range . The drill team should have mobilised to site by the time you read this, and the drilling campaign will kick off in just days. This potential “nickel kitchen” is such a big deal that even BHP decided it needed to be part of the action. BHP invested 2 years and $3 million in exploration on this tiny company’s flagship nickel project. BHP must have liked what they saw because they exercised their option to proceed with an earn-in for 70% of the project. But since BHP decided to focus on its core producing assets and move away from higher risk exploration, they recently handed their share of the project back to this company, along with $3 million worth of exploration data. Correct – SGQ did not have to pay a cent for the BHP data. This had nothing to do with the lack of prospectivity – it was just a change in corporate strategy for the giant miner. Instead of exploring, BHP is now focussing on current cash flow. So the result is that BHP literally gave away their stake in an entire nickel exploration field to our latest portfolio addition. As well as all that exploration spending, this company has poached one of BHP’s specialist nickel geologists – this project must have been too good for him to give up – he has swapped a BHP salary for exposure to a nickel discovery – this is how much he believes in it. He is taking on some added risk... but with higher risk comes higher reward. Newexco are on board here too... You may remember them from such nickel discoveries as Nova-Bollinger (Sirius) and Spotted Quoll and Flying Fox (Western Areas). To top it off, drilling is due to start in just days – if it hasn’t already started by the time you read this – soon investors will know exactly what is behind the glowing magnetic targets. This company is freshly cashed up to the tune of over $1 million following a heavily oversubscribed capital raising. The free float available here is less than 80 million shares – that’s small. And important – because if this company manages to find something, the share price may go parabolic as investors scramble to get in. Multiple analysts have rated this company as a “Speculative Buy”. So a ‘big company’ project is back 100% in this company’s lap, a small, well-run explorer with a market cap currently less than $12 million... With a recent surge in the nickel price, the timing could not be better. Introducing the Next Mining Boom ’s latest portfolio addition:

Countdown to estimated start date of nickel drilling campaign by SGQ:

St George Mining Ltd (ASX:SGQ) is exploring a previously untouched prospective nickel province in outback Western Australia. It’s called the East Laverton Nickel Project – and it’s big – over 2,000 km 2 in land holdings. Fresh off the back of a heavily oversubscribed capital raising of over $1 million, SGQ’s drill team has mobilised to site, and will get to work in the next few days:

![]()

Countdown to estimated start date of nickel drilling campaign by SGQ:

A steady stream of drill results will be released in the coming weeks by SGQ. BHP had already spent $3 million in exploration of the East Laverton Nickel Project with SGQ, before deciding to shift focus away from higher risk nickel exploration... so now it’s all SGQ’s:

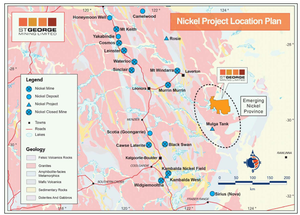

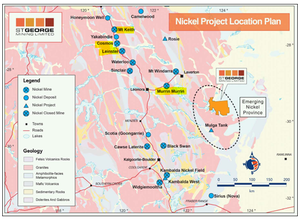

The Agnew-Wiluna nickel belt has led to a series of famous and profitable nickel mines plus a host of big discoveries dotting the landscape, all to the west of SGQ’s land:

- BHP’s Mt Keith mine, a 335 Mt deposit @ 0.516% Ni

- BHP’s Perseverance mine at Leinster, 121 Mt @ 1.15% Ni

- Xstrata’s Cosmos mine: 60 Mt @ 0.813% Ni

- MMC Norilsk Nickel’s Honeymoon Well deposit: 189 Mt @ 0.69% Ni

- Multiple mines around Kambala and Kalgoorlie

- Plus over to the south east in the Fraser Range, a discovery that you may have heard of before – the recent Sirius’ Nova discovery.

The map above shows the mines and deposits marked with blue circles. Following a boom in the 1970s, the discoveries have started to dry up on this nickel belt. SGQ are hoping to uncover the next frontier – their land is completely unexplored for nickel sulphides and contains ultramafic rocks that are similar to the profitable Agnew-Wiluna belt. SGQ believe that the next big discovery in their patch to the east may happen here. Early stage scout drilling by BHP has supported this thesis. And in just a matter of days SGQ will be firing up the drill rig again – and a steady stream of assay results will be coming through in the coming weeks.

Countdown to estimated start date of nickel drilling campaign by SGQ:

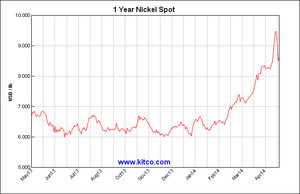

Within SGQ’s sprawling East Laverton project lie multiple large nickel prospects...SGQ may be sitting on something very special at one, or more of them. While BHP has decided to leave nickel exploration alone for the time being, their interest in SGQ’s ground no doubt piqued the interest of other majors... Mining giants like the $1 billion Western Areas or $1 billion Independence Group would love to find another Sirius-sized nickel deposit to sink their teeth into. A few nice nickel intercepts and SGQ could very quickly become a takeover target for a bigger company... And with a recent surge in the nickel price – it’s up 50% in the year to date, despite a recent correction – any finds SGQ make will become a whole lot more attractive:

Because of the sheer size of SGQ’s project, and the number of big prospects with ideal nickel geology, it’s possible that a nickel discovery could be flanked by more. And with SGQ’s loyal shareholder base and very tight capital structure, a discovery should reward shareholders very handsomely indeed. The big investors in SGQ know the potential, and are in it for the big prize – they won’t be interested in selling for a few ticks profit. A number of Analysts have also covered SGQ: Simon Tonkin from Patersons recently put a “ Speculative Buy ” recommendation on SGQ:

And Andrew Muir from RM Capital also rated SGQ a “ Speculative Buy ”:

Our Track Record

Did you receive The Next Small Cap article on Segue Resources (ASX:SEG)? Since this article was released, SEG has been up as high as 130%.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

BHP spends $3 million on exploration

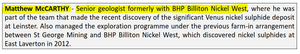

After stringent due diligence, BHP chose to farm in to parts of SGQ’s East Laverton ground back in April 2011 , to earn up to 70%:

This joint venture was coined ‘Project Dragon’, and covered 7 core tenements covering 498 km2. SGQ had accepted they might only retain a 30% interest under the BHP joint venture... And this was fine, because with the support of a cashed up behemoth like BHP behind you, and still retaining 30% of what has the potential to be big, it’s still well worth holding on to. The fact BHP invested is undeniable validation of SGQ’s ground and its geological modelling. BHP saw the potential for multiple, large scale, big dollar nickel sulphide deposits, within a new nickel province. They are a multi-billion dollar mining giant with thousands of shareholders watching their every move – they have a very high hurdle before committing to exploration. BHP don’t get out of bed anything less than world class potential – they only chase big ideas and big deposits. However, a bunch of spreadsheet shuffling bean counters forced BHP to implement an asset consolidation and exploration pullback policy (in other words cut exploration costs) and as a result BHP left the venture in October 2013. Nickel was deemed “non-core” to BHP’s portfolio you see. But SGQ’s East Laverton Project still carries all the geological features and upside that attracted BHP in the first place. Now the only difference is that every inch of it, and every gram of nickel discovered, belongs solely to SGQ. And the best part is that the big nickel targets generated by Project Dragon will be advanced by a team that includes ex-BHP geologist and nickel specialist Matthew McCarthy. He was co-ordinating the original farm-in exploration for BHP:

So not only did SGQ get the farm, they also got the farmer! BHP spent 2 years exploring and scout drilling methodically proving up the targets, and drilled 35 RC (reverse circulation) holes for 8,560m during Project Dragon. In fact, 28 of the 35 holes intercepted geology strongly indicative of a big nickel sulphide deposit lurking in close proximity.

![]()

The full results can be found here :

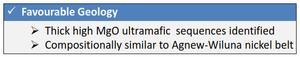

BHP drilling defined widespread komatiite, a high-magnesium volcanic rock that is a very fertile breeding ground for large nickel ore bodies. It’s a geological setting eerily similar to the wildly successful Agnew-Wiluna Belt to the west of SGQ:

The Angew-Wiluna belt is the most significant nickel belt in WA, boasting some of the world’s largest komatiite-hosted nickel sulphide deposits – and created BHP’s gargantuan Mt Keith operations, which hosts 335 million tonnes of nickel sulphide. Pentlandite was also identified in multiple holes – a very high grade form of nickel sulphide. So if SGQ can find a deposit – it’s likely to be high grade, as well as large. BHP spent $3 million and did a lot of work proving SGQ’s theory of a new nickel province... And then just handed over all that priceless information to SGQ for absolutely nothing! So a ‘big company’ project is back 100% in SGQ’s lap, a small, well-run explorer with a market cap currently less than $12 million. And now, SGQ is free to complete exploration, and without the limiting boundaries that were in place to cordon off the previous joint venture areas... And have 100% exposure to any finds they manage to make.

Countdown to estimated start date of nickel drilling campaign by SGQ:

It’s all about the Register

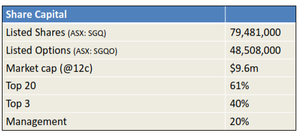

SGQ have a loyal band of insiders with big shareholdings... Their holdings are big because they believe in the geology of East Laverton, and they don’t sell shares every time the price goes up:

The free float is the number of shares that will actually be made available to buy on market. With less than 80 million shares on issue, the free float with SGQ is VERY small. This means that in the event of a big nickel discovery, the share price may go parabolic as investors scramble to get in. As investors, we don’t like to be one of the scramblers chasing higher and higher prices. The only way to avoid this is to take a position early, while some uncertainty remains. There’s nothing better than seeing upper management holding on to a big chunk of shares as a long term investment. With SGQ, management hold 1/5th of the entire issued capital. The top 3 holders control a whopping 40% of the register. And the top 20, who won’t be daytraders looking to flip stock for a quick profit, currently own 61%. So the free float is really only about 32 million shares... if SGQ can prove up something big, then a decent parcel of shares might be very difficult to come across.

Our Track Record

Regular readers are well aware of The Next Oil Rush ‘tip of the decade’ – TSX:AOI – Back in February 2012 The Next Oil Rush called it at around CAD$1.8 and has been as high as CAD$11.25 since – that’s over 600%!

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

High Probability Geology

The Agnew–Wiluna belt in W.A. carries two of the world’s largest komatiite-hosted nickel sulphide deposits in BHP’s own Mt Keith and Leinster. Komatiite is a type of volcanic rock, very rich in magnesium oxide (MgO), known to host enormous and high grade nickel sulphide deposits. And BHP’s own exploration data, including early stage drilling, from Project Dragon has provided further evidence that SGQ’s targets have the potential to contain large scale nickel sulphide mineralisation. The Agnew-Wiluna nickel belt is the biggest komatiitic nickel belt in the world, but most of the nickel there has already been uncovered. In addition to the giant Mt Keith, BHP have the Perseverance nickel deposit at Leinster which has 1,390,000 tonnes of contained nickel – one of the world’s largest high grade deposits with 121 Mt @ 1.15% including a very high grade 3.1 Mt @ 4.8% Ni. There is also Norilsk Nickel’s 189 million tonne Lake Johnston deposit at 0.69% nickel, and Glencore-Xstrata’ Cosmos Deeps 60 million tonne deposit at 0.81% nickel. The next big finds will likely come from new frontiers – like where SGQ controls a huge block of land over to the east... That’s exactly what got BHP interested in the first place. In the map below you can see BHP’s Mt Keith and Leinster, and other famous nickel mines like Murrin Murrin and Cosmos, to the west of SGQ’s big orange paddock:

SGQ has its own belts, three of them – the Stella Range, Central and Minigwal. All indications are that they share distinct similarities to the Agnew-Wiluna Belt. That’s right – early drill results indicate the potential of a nickel sulphide belt on the scale of Agnew-Wiluna. The main game for the upcoming drilling is the Stella Range Belt, where SGQ control some 60 km of strike length... this is the specific area that BHP were proposing to focus on in their next exploration phase. It’s a very large and very prospective target area – BHP wouldn’t get out of bed for anything less. And it’s precisely what SGQ will be drilling along and into in just days. In fact the drilling team should already be on site by the time you are reading this article:

Countdown to estimated start date of nickel drilling campaign by SGQ:

Early stage drilling at East Laverton has uncovered large scale, high magnesium oxide ultramafic sequences, just like Agnew-Wiluna, that support the “big nickel” theory. The big takeaway here is that there has been no previous nickel sulphide focused exploration, just like the Fraser Range pre-Sirius. SGQ spotted the nickel potential before anyone else, did the science, and now BHP has left the party they will be 100% sole recipients of potential rewards.

Our Track Record:

Did you see The Next Oil Rush report on Swala Energy (ASX:SWE)? SWE has traded as high as 150% since:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Razor Sharp Exploration

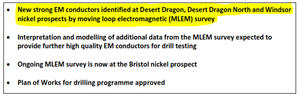

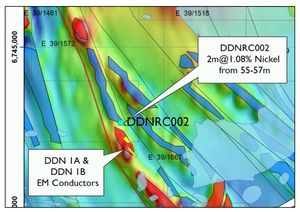

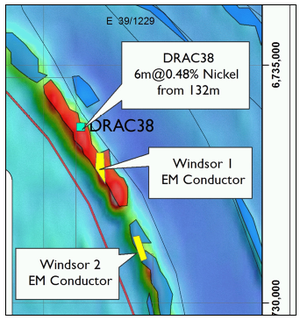

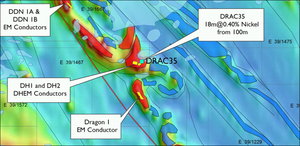

After BHP left to focus on its big producing mines, SGQ used their renewed control to start a systematic electro-magnetic survey, which is now nearing completion over the priority area of the Stella Range where nickel bearing ultramafic has already been identified. The other two belts and the northern portion of the Stella Range are yet to be surveyed. Utilising the uber-successful geophysics firm Newexco, SGQ announced on April 8th 2014 that they had discovered 4 new high probability conductors:

SGQ recently added one more conductor to their list of drilling targets:

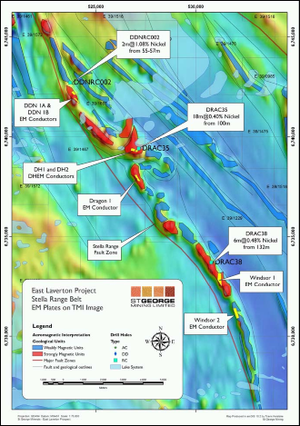

You may remember from The Next Small Cap article on Segue Resources (ASX:SEG) that Newexco was instrumental in the giant nickel discoveries of Sirius, as well as Western Areas’ Spotted Quoll and Flying Fox deposits. Newexco has rated several of SGQ’s conductors as Category 1 due to the coincidence of a number of key indicators... When Newexco rate a conductor as Category 1 – this means it’s drill ready and looking highly prospective. If the experts’ expert says SGQ has the highest possible chance of a nickel deposit, we aren’t going to argue. Investors have been waiting several months for this drilling... Luckily, the wait is just about over, and SGQ remains under the radar. For the first time, SGQ will drill into priority conductors on the Stella Range belt. SGQ has combined the wealth of geological information generated by BHP with its own analytics to create a juggernaut of nickel exploration data. This comprehensive database is pinpointing the most precise locations to drill, where the likelihood of a company-making discovery is at its peak. The below image gives an overview of major conductors recently caught on tape at the Desert Dragon North, Desert Dragon, and Windsor prospects. The red zones are what SGQ and Newexco are terming “Strongly Magnetic Units”:

The first conductor identified is at Desert Dragon North. This conductor is coincident with a strong magnetic high and elevated nickel and copper soil values. It’s also close to a nickel intersection that had visible massive sulphide veinlets, and is one of the Category 1 targets:

A further two new conductors have been identified at the nearby Windsor nickel prospect. The second Windsor conductor has also been given a Category 1 ranking by Newexco.

The ongoing moving loop magnetics have just discovered yet another big conductor at the Desert Dragon prospect, which is again coincident with known magnetic anomalies. In addition to these, at Desert Dragon, SGQ conducted downhole electro-magnetics to track down nickel mineralisation they believe was narrowly missed during previous drilling. SGQ’s instinct was proven correct – they found two strong conductors in close vicinity at around 135 metres deep:

All of these conductors will be tested in the upcoming drilling program. And, SGQ expects that results from ongoing electro-magnetics will add to its pipeline of prospects from the multiple ultramafic belts that run through East Laverton. The big blue sky potential in SGQ is that they are hoping to make multiple discoveries and define a new nickel belt – maybe a “New Fraser Range”. It won’t be easy – but the rewards would be impressive for SGQ investors...

Countdown to estimated start date of nickel drilling campaign by SGQ:

SGQ vs Sirius

SGQ is aiming for a different style of nickel deposit than Sirius – SGQ’s targets are not “eye-features”. East Laverton is a different geological setting, but the virgin nature and level of prospectivity is looking somewhat like the Fraser Range before Nova and Bollinger were discovered. Sirius has probably discovered most of what lies within their tenement boundaries. To be honest here at the Next Mining Boom , big discoveries don’t really excite us after they have been factored in to the share price. Sirius is now capitalised at $685 million, and shares are trading at around $2.60... great if you bought at 10c, but now it might be time to start thinking about the next big thing.

The good thing about SGQ is that they only have about 1/3 of the shares on issue that Sirius has... So if SGQ get lucky and make a discovery, even if it’s only half as big, the rise in share price may be similar.

SGQ vs the Investor checklist

SGQ is very tightly held, 20% owned by management and the top 3 shareholders own 40% of the company. Plus the senior geologist from BHP responsible for the project just crossed to the SGQ camp. The management team has put their money where their mouths are. Does the company have a small market cap? SGQ is currently valued at less than $12 million... They have just raised over $1 million in a heavily oversubscribed capital raising . Combined with the tight share register any big nickel discovery may spark a very sharp and sustained move north. Are there upcoming price catalysts? In just days SGQ will commence their high impact drilling campaign. In a few weeks assays will start flowing onto the screens of investors across Australia. In parallel, SGQ is continuing electro-magnetic work to further refine even more drill targets.

The Next Mining Boom Conclusion

SGQ is a genuine first mover and standout amongst junior nickel explorers. A virtual monopoly in its geographic region, methodically zeroing in on what could be a hive of undiscovered nickel deposits. SGQ retain the benefits of BHP’s technical expertise during early exploration and yet still hold a 100% interest across its suite of high impact nickel prospects. The $3 million poured into the ground by BHP at East Laverton has primed SGQ for the upcoming drilling just days away... if it hasn’t already started! Ideal host geology has been confirmed with comprehensive geophysical surveys, soil sampling and scout drilling... Will now be the time for the years of work and millions spent to culminate into one almighty payday? The drill bit will soon tell...

Countdown to estimated start date of nickel drilling campaign by SGQ:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.