ASX Stock Set for Spanish Bull Run with Uranium Production

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Are we about to see a recovery in the uranium price over the coming years?

With US utilities set to re-contract in 2018, and Chinese and Indian new reactor demand set to surge, one dual listed (ASX and AIM) stock has timed its run into uranium production well.

This company is set to begin mining uranium by the end of 2018 – just as analysts are forecasting a rebound.

This company’s mine has enough recoverable uranium to power the whole of the UK’s electricity needs for five and a half years.

The reason this company can push the button on development of the only new uranium mine in the world today is that it has a very distinct combination of low capital and low operating costs.

So low in fact that the mine can generate considerable returns even at current depressed uranium prices.

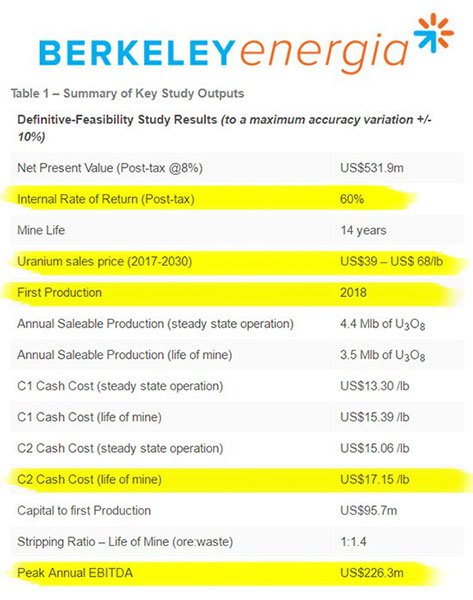

A recent Definitive Feasibility Study (DFS) found that the ultra-low operating costs of US$15 per lb are well below the current spot price of US$25 per pound – this ensures strong cashflows even at today’s prices.

But what has really piqued the interest of investors is the Letter of Intent (LoI) the company has just signed with a European based commodity trading company for the first million pounds of production at an average of US$41 per lb – giving it the kind of cashflow margin you would expect at the top of the cycle, not at the bottom.

Low operating costs normally come with high capital costs, however a decade of EU funded infrastructure in Spain has lowered the project’s initial capex to a bitesize US$100 million, well below the level for comparable projects around the world.

The company is currently capped at $160M, and with over US$12M cash on hand, it is fully funded through its initial development phase.

This company’s Spanish project hosts just under 90 million pounds of uranium, with the potential to expand the resource even further at depth. It could also look to explore the surrounding area which is also uranium rich.

Whether it does this is speculative at this stage and not guaranteed to happen. As such you should seek professional financial advice before making your investment decision.

This company’s share price has made strong gains in recent times having risen from $0.20 a share to reach a high of $0.86 per share in July 2016 and is currently hovering around $0.80 per share.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

We are expecting continued upward momentum in this company, and with a slew of high profile and deep pocketed investors on board, who will unlikely be selling for small pips, we will be watching this stock hopefully blossom over the coming months as it targets production.

Interestingly, the momentum behind this company has been building whilst the price of the underlying commodity and companies in the uranium sector have been flat.

However there seem to be a change in the air and investors could be looking for the next commodity ready to take off, especially one which has a highly experienced team that has already developed three major mines in Spain.

Uranium could be the next commodity to capture investor interest.

Here’s why....

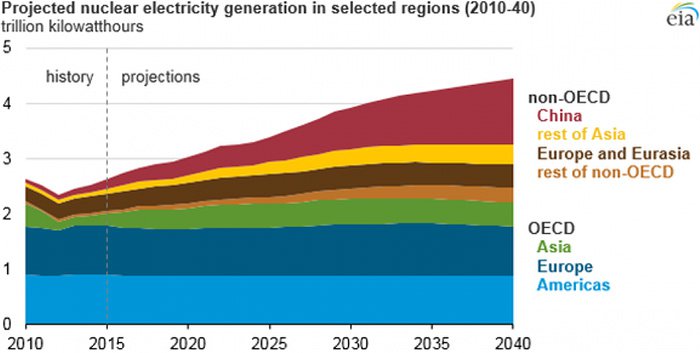

Energy demands around the globe are rising exponentially as populations increase, particularly in areas such as China and India where many people are rising out of poverty and moving into the middle class.

With governments around the world looking to move away from fossil fuels, many are investing heavily in nuclear power to ensure that the future energy needs of the public can be satisfied – again this is particularly apparent in China and India.

Should the uranium price improve as anticipated, profit margins for this company could rapidly increase and backed by its project economics and surrounding macro events, this company has the potential to become a major producer in the uranium industry over the coming years.

So let’s shine a nuclear light on...

Scalable clean energy solutions will likely combine renewable energy with nuclear energy for the foreseeable future: nuclear is still the cheapest and cleanest form of energy available today, by an order of magnitude when comparing the costs of producing 1 kilowatt hour of energy.

With an energy crisis on the horizon and coal power seemingly being phased out rapidly due to concerns over CO 2 emissions, nuclear power will likely increase its role in future energy provision.

Governments around the world are being proactive by investing billions of dollars into building nuclear power plants, hence why future demand for the commodity is set to increase.

Here’s an interview with Paul Atherly, the Managing Director of Berkley Energia (ASX | AIM:BKY), discussing this trend, while also looking at the specifics of BKY, its projects and its place in the uranium sector:

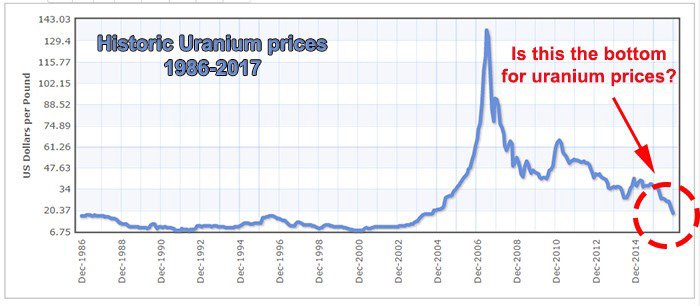

The takeaway from the video above, is that Atherley, along with a host of industry analysts, believe the uranium sector has been bottoming out and waiting to turn. Meanwhile, the key factor that will drive the price of uranium higher will be supply disruptions such as mines closing as we are seeing now.

The world’s largest uranium company, Cameco Corporation (TSE:CCO) recently closed some mines and laid off 500 workers ...

Despite this, even with the current uranium spot price, BKY could be one of the few profitable uranium miners on the market, offering significant upside should the prices of the commodity pick up as expected.

Where BKY differentiates itself from its peers is in its low operating and production costs.

Production costs in the industry average US$39 per pound, with a current uranium spot price of US$25 per pound. And those economics just don’t add up...

Meanwhile BKY can produce life of mine uranium at US$17.50 per pound, as confirmed by an independent DFS completed earlier this year.

BKY could be considered quite undervalued right now, given that once in production, the company’s annual cashflow will be greater than the company’s current market cap of $160M AUD at 80.0c per share.

This fact caused Dave Talbot of Dundee Securities to recently upgrade his target for BKY , giving it a discounted rating on the stock over three times greater than the current share price.

However at the same time, analyst predictions are no guarantee to eventuate, and should not be used to make an investment decision alone.

BKY’s Salamanca project is set to commence production around the end of 2018/early 2019, which happens to coincide with growing demand factors for the uranium commodity.

Strong future demand for uranium

By the time BKY is in production, post 2018, not only will US utility companies be re-contracting, but we will likely see new additional demand from reactors being built in China and India.

It is estimated that world uranium consumption is projected to grow at an average annual rate of 4.8% from 2015 to a total of 97,900 tonnes of uranium in 2020.

A significant driver of demand is expected to come from highly populated emerging economies and the push towards low carbon emitting energy supplies – such as nuclear.

As can be seen in the graph below, there is a widening deficit between demand and supply coming... And BKY is well positioned to capitalise.

With new projects generally taking around 10 years to become operational, it’s not as though a switch can be flicked and all of a sudden supply can meet excessive demand.

There is a significant lag effect which would further place inflationary pressure on uranium.

Simple laws of supply and demand tell us uranium prices could rise, especially when supply is being dwindled away at today’s low prices.

The uranium price could move quickly to the upside as it did from the start of 2004 when it was under US$20 per pound, to 2007 when the spot price jumped to over $130 a pound.

The price surge has happened before so it could happen again. Certainly that is the prediction in some circles.

“The uranium price rise will be violent”

-RobChang, Cantor Fitzgerald

This chart indicates exactly where it may head – could we see a return to 2007 price levels?

If uranium does rise to expected levels, BKY could receive a substantial re-rating, given its low cost project economics.

Now at the same time, there is no hard and fast guarantee that the uranium price will definitely go higher – this is a fluctuating commodity after all. Seek professional financial advice if considering making an investment here.

Let’s now take a closer look at BKY’s uranium project at Salamanca.

Three deposits at Salamanca

Located in the central west of Spain is BKY’s premier Salamanca uranium project that hosts a combined 82.6Mt with 89.3 Mlbs U 3 O 8 .

The Salamanca project consist of 3 deposits:

- Zona 7

- Alameda

- Retortillo

Zona 7 and Retortillo are located within 10km of the processing plant, with the Alameda deposit 35km away.

Out of the three projects, Salamanca is the most advanced with over 11,000m drilled in 2016 alone.

The site also hosts ten near surface targets, with the mineral itself at shallow depths, allowing for an open pit construction which may become an underground mine as the project advances and further exploration is carried out at depth.

Salamanca is one of world’s lowest cost uranium projects

An independent DFS completed in July of this year concluded that Salamanca is capable of producing strong margins even assuming the current low price of uranium is maintained.

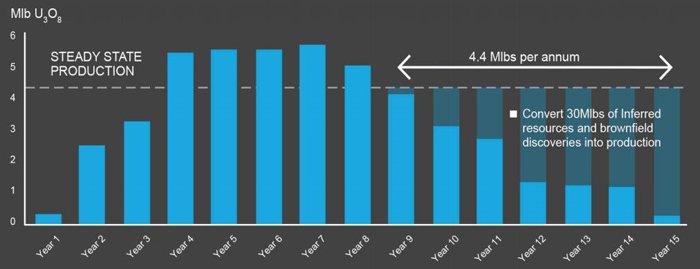

The report found that during the initial 10 year period, the Salamanca project would be capable of producing an average of 4.4 million pounds of uranium per year at a cash cost of US$13.30 per pound and a total cash cost of US$15.06 per pound.

The report used a spot price of US$26 per pound and term contract price of US$41 per pound.

Whilst many other miners are being forced to close mines due to the low spot price in uranium, BKY’s project is still profitable even at the current low prices.

Here’s how BKY compares to its peers given its ultra-low capital and operating costs.

Using the most recent UxC forward curve of uranium prices, BKY’s project is expected to generate an annual average net profit of US$116million.

One of the major strengths outlined for BKY was the fact that operating costs will almost exclusively be paid in Euros, whilst revenues received will be in US dollars.

The favourable spread is set to increase in BKY’s favour as deflationary pressures continue within the EU.

A further advantage is BKY is using EU funded infrastructure, and this combined with Zona’s low operating costs make a significant difference.

Here’s further insight into the cost structure.

Being an open cut project also helps reduce the costs, with BKY incorporating a mine design friendly to the environment with the money saved, allowing for ongoing rehabilitation of the land to take place so that agriculture is restored to the mined area.

Initial mine life of Salamanca is set at 14 years based on mining and treating the measures and indicated resources of 59.8 million pounds.

However, this will likely be expanded with ongoing exploration programs which offer generous tax incentives. The initial DFS was only carried out to a depth of 100m, as a result further exploration at depth is required.

BKY plans to convert some of the 29.6 million pounds of inferred resource into the minable zone. This coupled with deeper drilling as mining commences and plans for new exploration discoveries in the region, could extend the mine life of the project considerably as it progresses.

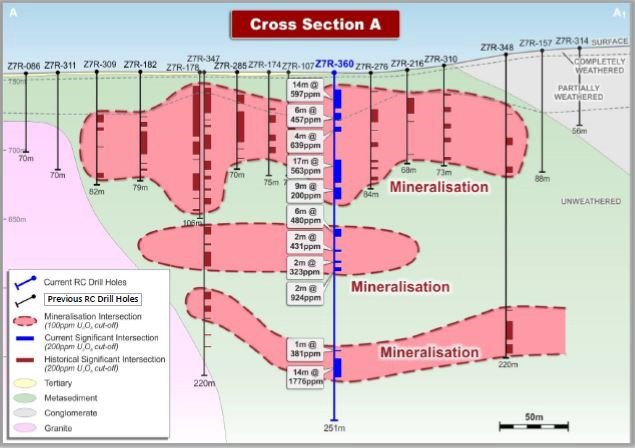

Earlier this month, high grade intercepts at Zona 7 confirmed the potential to upgrade the resource with strikes both near surface and at a maximum depth of 271m.

The intercepts included:

- 14 metres @ 1,776 ppm U 3 O 8 8 metres @ 2,644 ppm U 3 O 8

- 26 metres @ 1,103 ppm U 3 O 8 4 metres @ 3,973 ppm U 3 O 8

- 10 metres @ 635 ppm U 3 O 8 1 metre @ 2,246 ppm U 3 O 8

- 14 metres @ 597 ppm U 3 O 8 2 metres @ 1,204 ppm U 3 O 8

- 17 metres @ 563 ppm U 3 O 8 2 metres @ 1,160 ppm U 3 O 8

There is a significant amount of ongoing drilling happening at Zona 7, and you can see drill locations here on the map:

Along with a cross section of Zona 7 showing mineralisation:

Please note that permitting and a mining license is still needed for Zona 7, which is expected to be received by late 2017.

First 1 million pounds already sold at a premium

The ability to transform a letter of intent agreement signed recently with Interalloys Trading Company (a European based commodity trading company) into a binding agreement, will see the initial million pounds of uranium concentrate from Salamanca sell for over US$41 per pound.

The sale of up to one million pounds of uranium will occur over a five year period which can be extended by mutual consent.

With a cost per pound of US$15, assuming this agreement becomes binding, BKY has locked in a significant margin already.

BKY is currently in discussion with another potential off-take partner seeking a similar deal to the one with Interalloys.

By signing early off-take deals, BKY is able to secure revenues in the initial stages of mine life, de-risking the project as it progresses.

However there is still some way to go before BKY enters production and anything can happen in this time. If considering BKY for your portfolio seek professional financial advice.

BKY plans to pursue a combination of fixed and market pricing in order to secure positive margins in the early years of mining operation whilst still being exposed to any uptick in price of the resource.

Over the initial ten-year period of mine life, the project is capable of producing an average of 4.4 million pounds of uranium per year for a total cash cost of US$15.06 per pound.

Here are the mine life expectations:

Near term production

One thing we look for here at The Next Mining Boom is companies that have the potential to evolve into something much bigger – and BKY certainly fits the bill.

With production set to commence by late 2018/early 2019, BKY is in the hot seat to meet the anticipated future uranium demand at a time when many projects in the sector are either being shelved due to low commodity prices or are many years off from production.

To exemplify this, many uranium projects found in Canada are at least 10-11 years away from production.

In the meantime, supply of uranium is beginning to dry up with the low price of the commodity forcing current miners to close up whilst at the same time greenfield uranium exploration companies are finding it difficult to raise capital in the current market climate.

But BKY is now just two years away from production start-up, and will be entering the market will exceptional timing...

High quality infrastructure and local support

The Salamanca project has benefits from newly installed EU funded infrastructure in the region, which allowed for an initial capital cost of only US$95.7M. This is a relatively low figure for a project of this magnitude based on international standards.

Access to the project is so good that BKY has to realign a road that actually runs over the deposit. This is rare as usually companies are spending millions of dollars to build roads to a site, due to their remote locations.

The Zona 7 deposit is only 10km down the road from the processing plant, with the Alameda deposit 35km away on flat roads.

A power line upgrade to the site has commenced.

Additionally BKY has established a strong relationship with the local community creating some 450 direct and 2000 indirect jobs. This is an area that has been hit by high long term unemployment, so BKY’s presence is a welcome one.

BKY plans to actively support the local councils and businesses ensuring that they benefit from the project, including a co-operative agreement with local municipalities to receive 0.2% in royalties and preference/priority of locals for jobs and training programs.

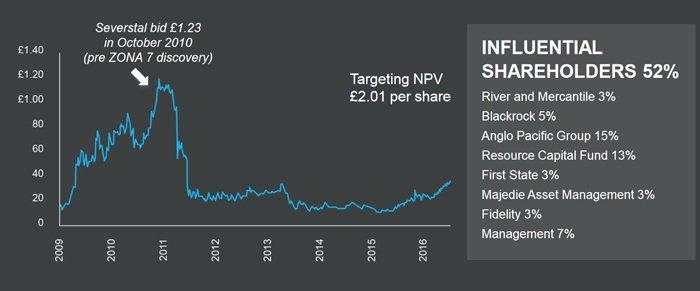

Big financial backers and shareholders

Influential shareholders in BKY consist of Anglo Pacific Group 15%, Resource Capital Fund 13%, BKY management 7%, Blackrock 5%, River and Mercantile 3%, First State 3%, Fidelity 4% and Majedie Asset Management 3%.

In total 52% of the company’s holdings are in in expert hands that want to see BKY run all the way to production, and likely aren’t in this for short term profit taking.

Strong support in BKY has been displayed through one of the major shareholders, Resource Capital Funds, who through royalty financing and a share placement recently injected US$10 million of capital into the company.

The capital was raised at a 15% premium to the then current 30-day VWAP share price.

The funds will be used to expand the resource at Salamanca and undertake infrastructure development ahead of the commencement of main construction later this year.

Final thoughts

Located in Spain, a uranium ‘bull run’ from here could increase BKY’s value significantly and is predicted by many analysts due to anticipated future demand.

Regardless, this is not necessary for BKY to see light at the end of the tunnel. With the Salamanca project being one of the world’s leading low cost projects, any increase in the uranium price is simply a bonus.

Even at these low prices for uranium, Salamanca is a money maker with production costs well below the industry average of US$39 per pound, with a current uranium spot price of around US$25 per pound. BKY sits at a cost of US$17.50 per pound for the life of the mine.

By paying costs in Euros and receiving revenues in US dollars, BKY will be able to take advantage of the spread between the two currencies which appears to be improving by the day as deflationary pressures continue to hamper the Euro.

With $10M recently received from one its main shareholders, BKY can continue on its path to production and along with funding exploration programs could further expand the already impressive resource size.

The financial backers and major shareholders in BKY are well respected companies that along with management make up 52% of the total holdings in BKY.

BKY has strong support from the local community, in addition to access to a large labour force and newly installed infrastructure funded by the EU.

With production at Salamanca set to begin in late 2018 early 2019, BKY is primed to come out of the bottom uranium cycle with a project ready to deliver for over a decade at very low costs and healthy margins.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.