ASX Stock Secures $30M on Path to Build Australia’s First Heavy Rare Earths Mine

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Today’s ASX company has the pedigree to take a serious bite out of the lucrative rare earths market — and the cherry on top is that this company has formulated its audacious plan right here in Australia.

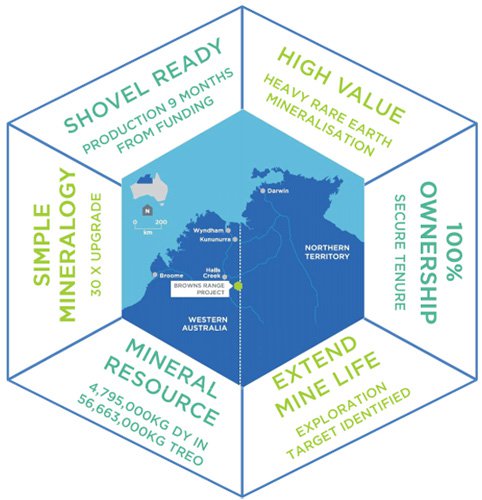

Some of the standout features in this junior are that it has an MoU for an offtake agreement in place, $30M in funding has been secured and its JORC’d and DFS’d flagship project is rated as ‘best-in-class’ on quantity and grade – with some estimates suggesting this project’s mining life could reach beyond 100 years on the back of its promising exploration targets.

This company wants to build Australia’s first ever heavy rare earths mine in WA, the first outside of China. This would be a huge feat for a company currently capped at around AU$70MN.

Once constructed, this mine, known as the Browns Range Project will be the only heavy rare earths mine in Australia – with heavy rare earths fetching considerably more money than light rare earths on the global market.

As the names suggest, heavy rare earths have heavier atomic weights than light rare earths, and they possess the properties to make smartphones, hybrid cars and other high-tech devices possible.

However, backing a speculative mining company at such an early stage means there is no guarantee of success here, so seek professional financial advice if considering this stock for your portfolio.

To build the mine, this company has a focused plan in place.

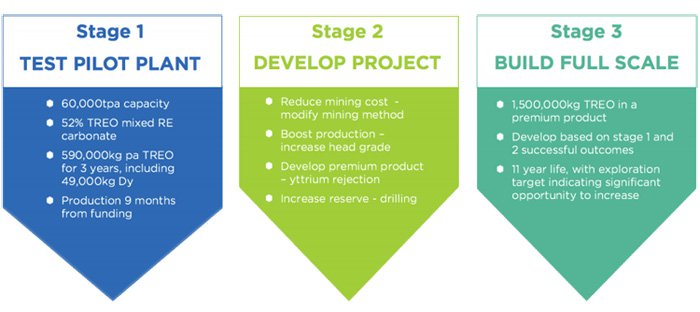

Put simply, the company has a three stage approach, which will start with the construction of a 60,000 tpa capacity pilot plant. Following that it will start to increase reserves and boost production, which will ultimately culminate in a full scale 1,500,000 kg TREO (total rare earth oxides) plant.

It is important to note here that the project is ‘shovel ready’ and it should be only nine months to production since funding was raised and 12 months from the issue of the purchase order.

Offtake negotiations have advanced to the point where a binding sales agreement may be imminent, beyond the current signed MoU.

So, which rare earth has this ASX company pinned its hopes to?

Most investors would have witnessed the surge in lithium stocks on the back of the rising demand for electric cars – well there is also another very important element required for electrics that could see new levels of demand – and it is called dysprosium .

Dysprosium prices are predicted to double in 12 months to US$400/kg (AU$524kg) and driving demand is an unlikely suspect: magnets.

Dysprosium is critical in high end permanent magnets and allows for optimal performance under load, for example at high temperatures in applications such as Electric and hybrid vehicles, Standard vehicles, Wind Turbines and Industrial applications.

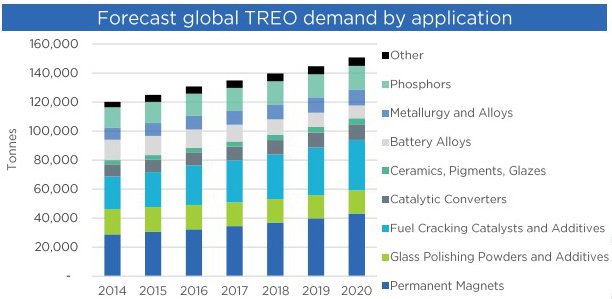

This ASX company has it in spades at its West Australian project along with other rare earth minerals, but it is dysprosium which is the go-to resource and potential profit maker for this company.The permanent magnet market is mainly driven by advantages offered by magnets in industrial as well as domestic operations and according to Markets and Markets will be worth $18BN by 2018 . Permanent magnets account for ̴25% of the rare earth demand in tonnes and ̴80% in value.

The permanent magnet market to grow at a CAGR of 7.1% to 2020...

Given what we now know about dysprosium, it is important to highlight once again that this company could be the first producer outside of China, and given this company’s indomitable nature and perseverance in getting its rare-earth ambitions to this stage — it looks as though it may have the wherewithal to see them through to a significantly higher valuation as the company heads toward first production.

Unveiling:

Northern Minerals (ASX:NTU) is a junior ‘miner in the making’ with some “rare” talents.

For years, NTU was transfixed on the uranium market; persevering to leverage itself to the growth of wholesale power generation. Yet, NTU identified an alternative approach to making commercial energy hay in the steppes of energy-commodity markets and decided to go in this direction instead.

Both NTU’s current strategy (as well as the specific markets it is going into) can be illustrated as change from this:

Into something that looks like this:

Where uranium can be complex, restricted and tightly wrapped by government regulations — rare earth minerals are far more straightforward to mine, process and sell in global commodities markets.

In parallel, the demand for rare earth minerals — and heavy rare earths in particular — is growing strongly on the back of a gradual shift towards cleaner energy, more efficient manufacturing and making everything lighter, smaller and cheaper.

Rare earths are helping all industries burst through the old-fashioned fossil-fuel-guzzling status quo, into a greener future that’s disruptively cracking into today’s energy monopoly.

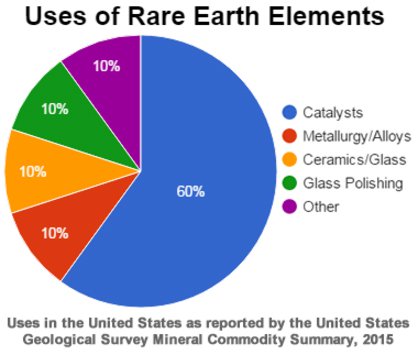

Rare earth elements are mainly used as catalysts to make other industrial or manufacturing processes work better and cheaper. In some respects, rare earths are like the garnish that goes into food to make it taste better, appeal to a far-wider audience and obtain higher prices for its host-product at the supermarket checkout.

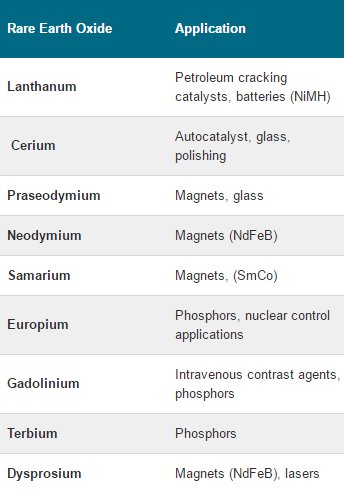

There are 17 different rare earth minerals — all with various traits and properties

Here’s a brief summary of the major rare-earths and their applications:

The one NTU is squarely focused on is Dysprosium...

Here is a video summarising the key role dysprosium is already playing in global commerce.

There are a huge variety of rare earth minerals, being used for an even larger variety of combinations, with a gargantuan list of possible applications...

... but NTU is primarily focusing on Dysprosium — a rare earth element with a particularly key role in the ongoing futurization of the globe.

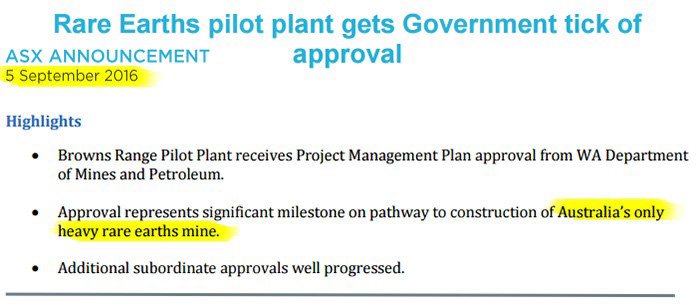

Even the federal government has realised how important this is with NTU receiving a key government approval last month that has given this company the green light to begin its march towards a pilot plant producing around 60,000 tonnes of rare earth minerals per year — and that’s only 10% of the final full-production rate.

Coming back to ‘futurization’, we literally mean the ongoing global transformation from the use of pollutive fossil fuels, into cleaner and more efficient forms of energy generation (and storage).

That’s a ticked box in any government department these days, so no wonder they are on board.

In broad strokes, the world is gradually moving from wasteful means of production, into more efficient alternatives...

...and this shift is dragging rare-earth output with it.

Dysprosium is a key ingredient in this transformation because it is used in electronics, large industrial machines, airplanes, industrial magnets and wind-turbines.

So to really understand how these tongue-twisting elements can beef up your wallet....

Forget crude oil, combustion engines, gasoline, spark plugs, generators and oil lamps — and think solar, sustainable energy, batteries, magnets, lasers and electric cars.

Dysprosium is usually added to permanent rare earth magnets to help them operate more efficiently at higher temperatures — and that’s exactly what the new wave of lithium-ion-battery-powered devices needs.

NTU is thinking along these lines, and has taken affirmative steps to snatch some market share away from the current market behemoth and old chestnut — China.

How much of this market share NTU can capture remains to be seen as it is still an early stage company with a long journey ahead. As such it is important to take a cautious approach to your investment decision in this company.

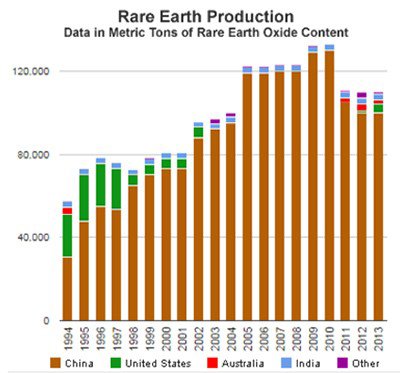

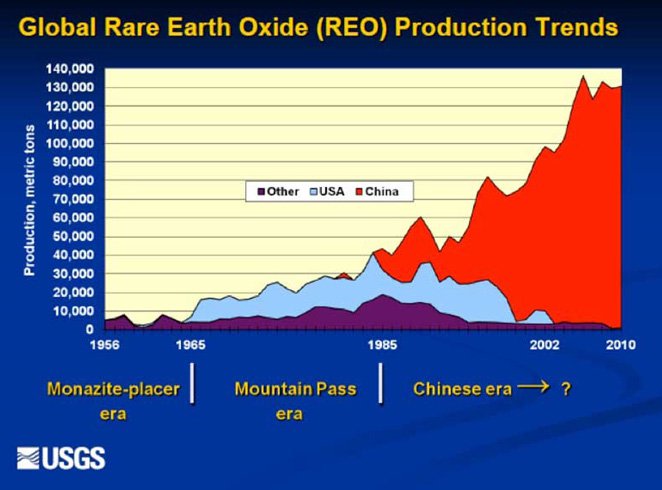

China currently produces over 95% of the world’s rare earth supply, but this is slowly changing in favour of places where rare-earths aren’t as rare as they seem — Australia’s commodity-laden Western hemisphere and Northern territories.

Best in class dysprosium project

NTU has got its hands on a best in class heavy-rare earths project, and is now gradually moving to develop it into a commercial entity by kicking off production of around 60,000t per year, and then raising that up to a full scale 1,500,000 kg TREO plant in several years’ time.

Let’s take a look at this pedigree in more detail...

As you saw higher up in this article, the WA authorities have approved NTU’s Browns Range Pilot Plant — which sits smack bang on the border between the Western Australia and the Northern Territory.

Browns Range

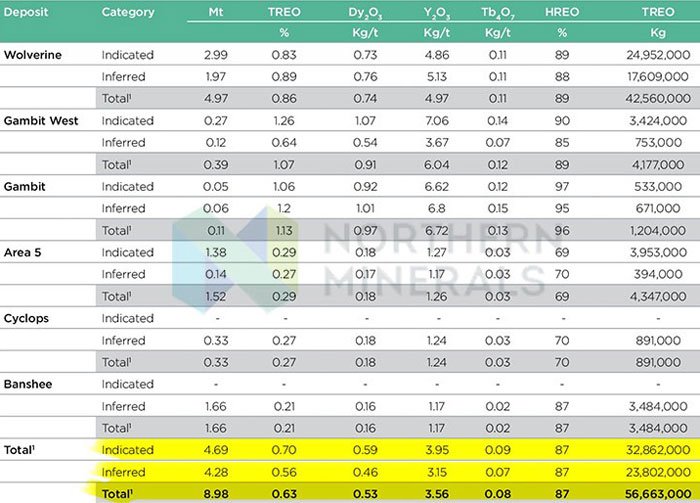

Since 2012, NTU has increased the Browns Range Project’s JORC compliant mineral resource fivefold with the estimate now standing at 4,759t dysprosium, within 56,663t TREO (total rare earth oxides).

The Total Mineral Resource at Browns is now estimated at 8.98 Mt @ 0.63% TREO, comprising 56,663t contained TREO using a cut-off grade of 0.15% TREO.

Here is a full summary of what NTU has already defined at Browns Range:

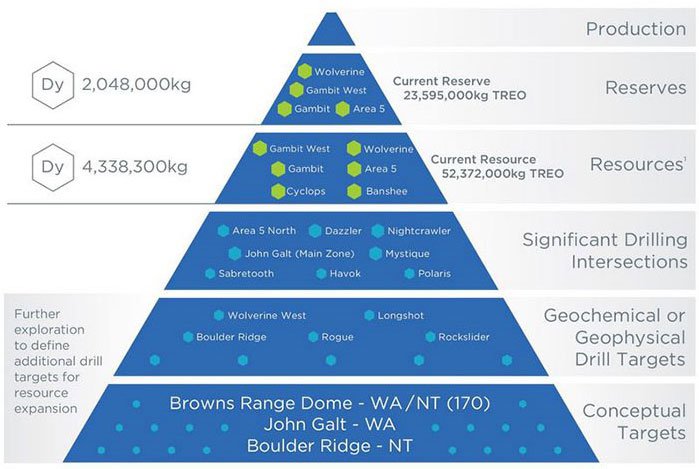

And here are those numbers transposed into a visual chart for your convenience, along with a host of exploration targets which NTU could look to beef up the already large JORC resource and extend mine life.

At the Wolverine deposit the total Mineral Resource is estimated at 4.97Mt @ 0.86% TREO comprising 42,560t TREO using a cut-off grade of 0.15% TREO. Of the Total Mineral Resource, 58% is classified as Indicated Resource, with the remainder in the Inferred Resource category.

The pilot plant will be approximately 10% of the size of the full scale operation and it has been designed to produce 49 tonnes of Dysprosium per year within 590 tonnes of total rare earth oxide produced each year.

Browns Range will be the first mine in Australia focused on the production of Dysprosium, which trades at two to three times the price of light rare earths.

The Pilot Plant is essentially the first stage in a planned development that could ultimately see a decision taken to establish a full-scale plant after 3 years, which would take a further 2 years to build.

NTU represents a good opportunity to take a position in Aussie-made rare-earths...

NTU has a definitive 3-stage plan in the works for Browns Range including a Bankable Feasibility Study (BFS) in the not-too-distant future — catalyst seekers take note

NTU wants to make sure Browns Range revels in the best possible project economics and has therefore brought in some big guns for both funding and project development.

A neat MoU for an offtake agreement with a reputable partner, combined with a progressive equity funding deal that’s already in the bag, is also something small-cap steeds should aspire to:

As any mining aficionado knows, project funding is a key component of any aspiring small-cap’s growth ambitions. At NTU, this aspect is squarely put to bed with a premium-to-market cornerstone funding just completed to accelerate project development and see NTU blossom into a producer in nine months’ time.

Final shareholder approvals for the $30M equity injection have been given.

This equity injection was instigated predominantly at a premium to NTU’s share price at the time – meaning investors may be able to take a stake in the company at a similar price to cornerstone investors right now.

The funding is to be delivered in two tranches, the first tranche was received on 12 August for $3M for 28 million shares at 10 cents per share.

The second is for $27M for 200 million shares at 13.5 cents per share (to be received within three equal tranches within 30, 60 and 90 days of the General Meeting).

NTU’s commercialisation track laid out

At this stage NTU is aiming to make a final decision to begin construction of the project infrastructure in January 2017 by commissioning the necessary parts and equipment.

NTU’s DFS currently estimates Browns Range NPV at around the $522M mark with required pre-production capital of $332M.

That may sound like a lot of cash, but given NTU’s resource estimates so far combined with a 60,000t per year output within the next few years — we think there is a good argument for backing NTU.

As we indicated earlier, one Chinese outfit is backing NTU via a $30M equity funding agreement just signed...

Chinese interests vying to expand global empire

Considering that over 90% of global rare-earth production comes from China, it’s not a huge surprise to see Chinese companies looking to strike JV deals, offtakes and MoUs overseas.

In NTU’s case, the Chinese financial backers are represented in Australia by Huatai Mining, the Australian investment arm of Chinese coal producer Shandong Taizhong Energy.

Huatai is set to emerge with up to 31% of NTU and will be a key partner in developing Browns Range as the world’s first significant producer of Dysprosium outside of China.

In other words, the Chinese want to hold onto their rare-earth empire for a while longer — which is something that an astute investor can leverage to his/her advantage.

China is also the dominant consumer of rare earths, which they use mainly in the manufacture of electronics products for domestic use, as well as export.

Japan and the United States are the world’s second and third largest consumers of rare earths. In 2010 and 2011, Chinese exports of rare earths fell, driven predominantly by increasing domestic consumption.

And herein lies possibly one of the biggest booms since Ford’s landmark Model T back in 1908 :

Lithium-ion batteries and the electronics bonanza made possible by efficient energy storage.

Chinese EV car manufacturers such as BYD and Changjiang are pushing domestic Chinese demand to the extent that China may raise its previously lacklustre imports of certain rare earths.

This may explain why Chinese companies are looking for offtakes and JVs in the first place.

The rapid pace of growth in these newly developing sectors (lithium, energy storage) is creating an extremely fertile environment for certain rare-earths, of which dysprosium happens to be one of.

On the electrical vehicle front in isolation, total sales of new-energy vehicles (electric and plug-in hybrids) in 2015 reached 188,700 units, up a staggering 223% compared to 2015 .

To give you a good example of how critically important rare-earths have become, think back to 2010 and China’s artificial restrictions on rare-earth exports.

China’s production monopoly combined with a supply restriction, triggered panic buying and some rare earth prices shot up exponentially . In addition, Japan, the US, and the EU complained to the World Trade Organization (WTO) about China’s restrictive rare earth trade policies.

If NTU can work up a rare earth resource as a supply alternative to China — it could be an incredibly astute move given current geopolitical tensions and the chronic spill-overs into price volatility.

Have a look at how another ASX rare-earths developer — Lynas Corporation (ASX:LYC) performed over the past decade — notice the spikes in 2006 and 2010 on the back of global rare earth bottlenecks.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

From its current low base, NTU will be hoping to emulate the peaks, not the troughs, and it has a long term play in its pocket as well that could potentially further its ambitions.

Who (or what) is John Galt?

Both John Galt and Boulder Ridge are considered longer-term plays than Browns Range, with both containing promising exploration targets.

There could be a day when John Galt and Boulder Ridge could feed a processing facility at Browns Range — but that’s blue sky thinking for now.

The John Galt project consists of 177 km 2 over three exploration permits in the East Kimberly. Since 2010, NTU has undertaken several rounds of geological mapping, soil and rock chip sampling at the project, with rock chips coming back grading as high as 42% TREO including 36,791ppm (3.68%) dysprosium.

Meanwhile at Boulder Ridge, NTU has a 100%-owned tenement (EL29594) in the Tanami region of the Northern Territory, about 100km south east of the Browns Range Project.

It is part of a tenement package which includes most of the eastern section of the Browns Range Dome, and extends southward toward the Tanami Gold mine.

A rock chip sampling program conducted at the project included some outstanding, high-grade assay results of greater than 12% TREO.

NTU will progress both John Galt and Boulder Ridge, but it’s Browns Range where the current focus is. Diamond drilling will be needed as a next step, and that’s a further tidbit of company news we’ll be looking forward to.

Catalyst by name, catalyst by nature

Rare-earths are catalysts by name and catalysts by nature, as they help propel the world into a more advanced future. Hopefully they will be a catalyst for NTU’s share price — the initial signs are that they most certainly are.

NTU’s recent activities have most certainly woken up the market to its potential, with its share price growing from $0.07 to as high as $0.16 per share since the news of its pilot plant approval in WA. The $30M placement by Shandong Taizhong has also played a role.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

This mining roly-poly keeps coming back

Admittedly, NTU has suffered setbacks in the past — both in its uranium development and cash-raising attempts.

However, as a famously wise man once said: Success is not in never failing, but rising every time you fall.

NTU has displayed dogged resilience in its mission to become a vital component of tomorrow’s energy generation and industrial efficiency. It has come back again and again and is now in a perfect position to take a flight as Australia’s answer to China’s rare-earth dominance.

Here’s that graphic summary again:

NTU has recently confirmed a $30 million equity funding agreement for its ambitious WA rare-earth production plans, and has already ear-marked sales channels for once production begins.

Production is yet to occur, and as with all large mines, further funding will be necessary, so seek professional financial advice and take into account all available information, not just what is in this article, before making an investment decision.

With governments and consumers around the world seeking to get off the fossil-fuel teat for good, NTU is part of a new breed of firms that are embracing new technology and despite its $70MN market cap, NTU could become the first major producer of dysprosium outside of China.

With NTU’s General Meeting dotting the Is and crossing the Ts, and a decision to commission plant infrastructure on course to be made in January 2017 — now could be the right time to back this lowly-priced mining roly-poly just as the sci-fi technology future digs its foundations and sets up the supply routes that will feed tomorrow’s world that all consumers are waiting for.

Revs up.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.