ASX Junior Triples Resource Size After Opportunistic Energy Acquisition

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The world is gradually moving away from fossil fuels for its energy.

We all know this.

But what most people may not realise is that the amount of energy being produced by renewables to fill the gap is nowhere near where it needs to be.

It’s all well and good hollering at fossil fuel guzzling producers and consumers, but what’s the alternative?

If you’re a believer that as a region, Asia is rapidly industrialising and therefore catching up to its uber-developed Western peers, there is a diligent way one can leverage Asia’s continued development, to their own back pocket.

In one word: Nuclear.

One company that’s perked our sensors has recently picked up one of only four fully permitted uranium mining operations in South Australia...

The company has more than tripled its resource size since project acquisition in December.

There is likely plenty more resource upgrades to come through – as it has only just scratched the surface in some regions, with kilometres of strike length still to be prodded.

The grades it is finding are higher than the majority of similar uranium operations in the USA and Kazakhstan.

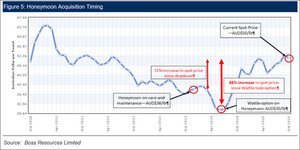

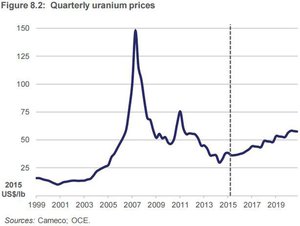

This company picked up this asset on the cheap, at a multi-year low point in the uranium price, at the same time the previous owner decided to focus more on Kazakhstan than Australia.

Some $170M was previously invested in plant and infrastructure – which was all sitting idle and waiting for someone to take charge to take into production.

And now it has.

This could be an energy play that defies the sanguine state of global commodity markets by remaining insulated from the noise of commodity speculators.

Furthermore, given its early stage status, this could be a growth story that jumps onto the Asia industrialisation story while keeping its feet grounded on the ASX.

It is however still a junior player in this sector and caution must be applied to any investment decision relating to this stock.

Introducing a Boss that intends to go nuclear:

Boss Resources (ASX:BOE) is already an advanced uranium developer simply through the astute acquisition of the Honeymoon uranium mine in South Australia.

The project has had a total increase in resource size of 330% since BOE got its hands on it, and most recently part of the western section of the project, Gould’s Dam, saw a 90% increase in resource size .

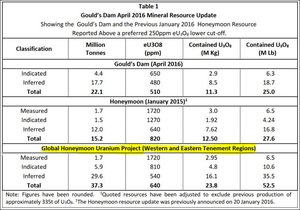

The mineral resources identified can be broadly split into West (Gould’s Dam) and East (Honeymoon), and a summary of it all is laid out in this table. The bottom section shows the global size of the entire Honeymoon Uranium Project:

Interestingly, BOE have yet to sink a drill hole here – these resource upgrades have come simply on the back of assessing the projects historical database...

Analysts from The Sophisticated Investor recently increased their valuation for BOE up to $0.23 per share – driven by an increase in the forecasted production rate. This represents a 475% gain on BOE’s current levels:

However, at the same time, this valuation is based on a number of assumptions which may not prove correct. Analysts don’t have crystal balls, and there is no absolute guarantee BOE will reach these levels – so caution is advised if considering an investment.

Instead of going out and doing all the groundwork themselves, BOE has effectively cut the path to production by claiming an asset with over $170MN in previous development spend and that is relatively closer to the finish line compared to BOE having to go it alone from scratch.

In fact, this project has already produced uranium in 2011 and 2012 – so this is clearly a ‘restart’.

If the project is so great, how could BOE take it from under the noses of the previous owner?

The reason was that the cyclical low point of the uranium price had been reached, and the previous owner was throwing all their eggs into the ‘Kazakhstan basket’ – owing to a partial takeover of that company by a Russian state owned entity, who was much less enthused about a project on the other side of the world.

As the uranium price recovers, it appears BOE has timed its run well as it gathers steam toward production.

Now at this point in time, we should add that there are funding risks – the company is funding care and maintenance at the Honeymoon mine and it’s working hard to cut these costs from $4-5M a year, down to $650k a year.

However, there is no guarantee that funds for its care or maintenance programs will be available at a reasonable cost or without dilution to existing shareholders – so caution should be taken in your investment decision.

In some ways, the BOE story reminds us of another Next Mining Boom favourite, Blackham Resources (ASX:BLK) – BLK picked up distressed gold assets on the cheap, including key infrastructure that was in care and maintenance, and has been readying itself for imminent production. We first brought you that story in May 2015 in the article ASX Junior to Unleash 100koz pa Gold Machine: Funding Now Secured – since then the stock has been up over 260%:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Can BOE repeat a similar feat, albeit this time on one of only four permitted Australian uranium projects?

Let’s take a look at what BOE has up its sleeve, and most importantly, how it could translate into commercial value for investors.

Location, location, location

As is the case with any Resource or Resource Company, the project location is an integral part of the broader economics. And it’s no different with uranium.

It may be an exotic commodity with niche uses, but the same broad principles apply to uranium miners as they do with miners of iron ore, gold or graphite for example.

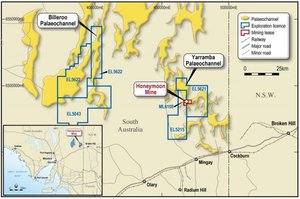

In BOE’s case its operations are located in the most conducive part of Australia, where there are already 2 operational uranium mines, historical geological fieldwork including high grade historic production and plenty of supportive infrastructure to ensure a smooth path from exploration to production.

Here’s BOE’s location in the grand scheme of things:

Located close to the border of South Australia and Victoria, BOE’s Honeymoon asset is in the heart of Australia’s uranium epicentre, where the majority of uranium is extracted and sent to market.

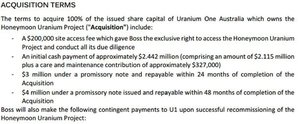

To secure the Honeymoon Uranium Project, BOE recently completed the acquisition of Uranium One in December 2015 and is now moving quickly to commercialise the deal.

Working as part of an 80/20 JV with privately held Wattle Mining, BOE has also remembered to include an option to acquire Wattle’s 20% interest at around the BFS stage, should that be a favourable option at that time.

It’s a tidy option to have in your back pocket which adds flexibility to BOE’s operations down the track.

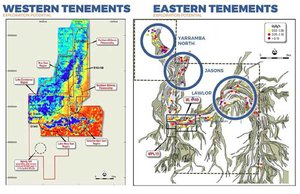

In total, BOE has 1 mining lease, 5 exploration licenses, 8 retention licenses and 2 miscellaneous purpose licenses spread across its 2,595 sq. km. tenement package.

Here are the terms of BOE’s deal with Wattle:

As you can see, BOE has managed to pick up Honeymoon for a reasonable $2.5MN paid now, with a further $7MN down the track in 2-4 years’ time as development progresses.

By our estimations, that’s somewhat of a bargain considering all the bells and whistles BOE gets as part of the deal, as we’ll explain later.

BOE is gradually scaling into its Honeymoon and is only obligated to pay more subject to progress – perfect for a small company that has its sights set on long-term success.

One key aspect for BOE is that Australia currently has 4 permitted uranium mines – Ranger in the Northern Territory and Olympic Dam, Beverley and Honeymoon in South Australia.

When it comes to uranium, obtaining permitting is often a lengthy and laborious process that can take 5-10 years.

Not only does BOE avoid all the permitting headaches, it also benefits from a de-facto barrier to entry for other explorers which means its operations are relatively insulated from competition.

This could be especially beneficial for BOE in the first few years of developing Honeymoon because the first years of a project are often the most important.

Obtaining a mining permit for uranium is very difficult given the understandable considerations such as safety risk and security. This inbuilt barrier to entry protects BOE’s market position because it disincentivises other market entrants and helps to ensure healthy sale prices.

In summary, here are the highlights of this Honeymoon:

With permitting not an issue, the next key element in BOE’s strategy is the Resource itself.

On this, BOE has potentially acquired one of the best uranium assets in the world – at just the right time given the expected rise in demand for uranium over the next 20 years.

Grading this Honeymoon

Historically, Honeymoon produced over 335t U 3 O 8 (uranium oxide) between 2011 and 2012.

BOE has just recently had its JORC Resource upgraded for the western Goulds Dam to 22.1Mt @ 510ppm (parts per million) eU 3 O 8 for 25Mlb (millions of pounds) of contained U 3 O 8 above a 250ppm eU 3 O 8 lower cut-off.

Here is Honeymoon’s Resource tabled in full:

The most confidence-inspiring element of its Resource is the Measured category which stands at 1.7Mt @ 1720ppm eU 3 O 8 for the eastern Honeymoon resource.

As you can from the table above, this number is well above the preferred uranium measurement of 250ppm – meaning this is high grade.

The numbers also mean that BOE already has around 1.7Mt at its fingertips that can get its operations going.

Over time, ongoing exploration will attempt to move more tonnage from the Inferred to the Indicated and Measured categories.

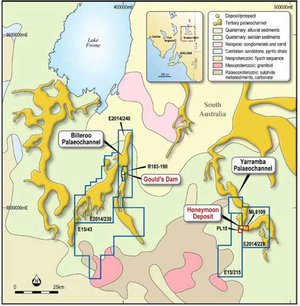

Taking a deeper look at BOE’s Honeymoon Project, there are two distinct sets of tenements that sit on different ‘ palaeochannels ’ (this is a remnant of an inactive river or stream channel that has been either filled or buried by younger sediment).

Significant sandstone-uranium deposits can be located in these paleochannels.

One batch is to the West which contains Gould’s Dam (Billeroo palaeochannel), and the Eastern tenements that contain the Honeymoon Deposit (Yarramba palaeochannel).

Reminiscent of the ongoing global macroeconomic tussles between East and West, there is also a tussle between East and West at BOE too.

East versus West

In the East, BOE has seen its Resource upgraded by 66% in recent months . BOE has an 11-25Mt exploration target here for 18-47Mlb of contained U 3 O 8 .

Not to be denied, the West recently added a maiden JORC resource for Gould’s Dam – which is now a 22.1 Mt at 510 ppm eU 3 O 8 for 25 mlb contained U 3 O 8 above a 250 ppm eU 3 O 8 lower cut off:

![]()

With 15km of strike length at Gould’s Dam and infill drilling to come, there is plenty of expansion potential in the future.

Historical drilling shows numerous >1000ppm U 3 O 8 intercepts which means BOE’s Eastern tenements have a chance of proving up premium grade uranium for years to come.

As a side note, bear in mind BOE’s three future prospects as shown above in the east: Lawlor, Jasons and Yarramba North. These prospects have already had some preliminary exploration done and should be duly advanced if all goes to plan.

On the subject of its share price, BOE has in many respects started its gradual climb. It’s still early days of course, but the 190% gain from September 2015 to earlier this year suggests BOE is onto something with its Honeymoon acquisition announced at the end of last year.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

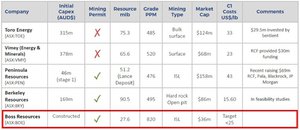

Another clue as to why BOE has started its move up could be because of its relatively superior metrics compared to its peers.

We love a peer comparison here at The Next Mining Boom , simply to know where our idea sits in perspective to what else is out there:

BOE has a smaller resource compared to its peers, but has a much better grade and uses the more effective ISL (in situ leach) mining technique which allows for lower production costs (more on this process below).

Probably the best “Unique Selling Point” for BOE is that its capex requirement is very low given the existence of existing infrastructure acquired as part of the Honeymoon acquisition.

This means BOE will not have to raise hundreds of millions of dollars and wait for considerable time to build integral infrastructure to begin production.

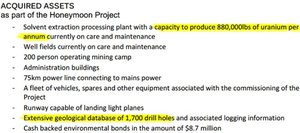

Here is a definitive list of BOE’s Honeymoon suite:

And here are some visuals of what some of that infrastructure looks like.

BOE has effectively managed to go from pillar to post in one diligent move.

From a cost perspective, BOE is aiming to produce uranium at below $25/lb, while market prices are averaging around $29/lb.

BOE is confident of achieving that courtesy of the ISL Process

Mining for uranium can be done in several different ways.

Digging the ore out of the ground can be expensive and time consuming whereas using ISL (in situ leach mining) is far quicker and more efficient.

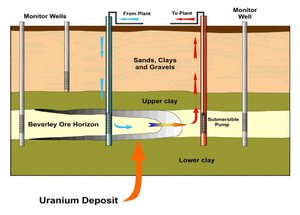

Here’s an illustration of the ISL process:

An acidic leach solution containing an oxidant is pumped down an injection well into the uranium-bearing layer of the soil beneath the ground (indicated by blue arrows).

The solution moves through the Beverley Ore Horizon and mobilises the sought-after uranium deposits into a solution that can then be sucked up via a parallel ejection well (red arrows) that goes directly to a processing plant.

The solution received by the processing plant is referred to as a ‘pregnant leach solution’ (PLS) that is then refined to extract uranium U 3 O 8 and prepared for shipping.

Here’s a quick video if you want to go deeper:

Let’s take a look at the broader uranium market globally to see where BOE will be casting its line.

From fossil to nuclear

The world is gradually going nuclear in an attempt to fill the energy gap created by rampant industrialisation in developing counties and a growing world population not satisfied with burning wasteful fossil fuels and renewables. Fossil fuels and renewables simply do not provide enough energy required.

Nuclear energy is the most conducive way of ramping up the required amount of energy supply to meet the surging demand.

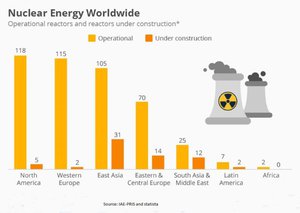

If we look closer, it’s clear that countries such as the US, many Europeans and Japan have already run out into the lead in terms of using nuclear reactors to generate electricity.

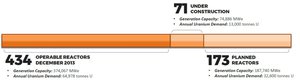

And now, Asian countries such as China and India in particular, are running full steam ahead playing catch-up. 71 are currently under construction with a further 173 planned.

The reasons behind China and India moving rapidly to cleaner energy is not only to have ample electricity, but also, to do something about this:

Chronic and widespread smog in Eastern China has put the frighteners into China’s leadership as rampant coal burning starts to levy hard to ignore social and environmental costs.

In the current economic cycle, China’s State Council is spending US$380 billion on conservation and on emissions cuts in the coming years as part of a broader “war on pollution” announced by China’s Premier in 2014.

The plan is to accelerate the closing of coal-fired power stations across China – and replace that lost output via nuclear and renewables that generate zero carbon emissions.

Once upon a time in China

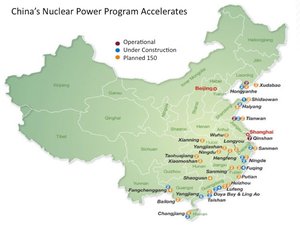

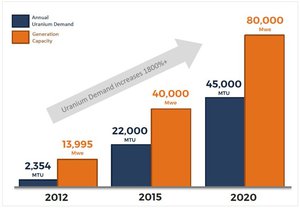

What China has planned in terms of its energy production in the coming years, could only be described as a gargantuan blitz of nuclear reactor construction.

Take a look at the emerging nuclear landscape, in China alone:

It is estimated that all those power plants will require an additional 40,000MTU over the next four years – representing an 1800% increase since 2012. That’s a huge ramp up which BOE could potentially become a significant part of.

As long as BOE can get production going, it’s likely its product will find a buyer.

Shown below is what China’s brand-spanking nuclear reactors look like in practice:

A model of a Hualong reactor at a conference in Beijing last year.

Following the Fukushima disaster in 2011, China’s government initially suspended the construction of additional nuclear power plants. But in the autumn of 2012, Beijing lifted the moratorium on future development – and since then, has reinvigorated its ambitious nuclear program.

The growth of China and India – otherwise known as ‘Chindia’ – is affecting lots of different sectors because of the huge size of the both these two countries size and growth rate.

When taken together, China and India account for over 2.5 billion people and standout as the two most prolific economies fighting for supremacy on the global stage.

With nuclear energy now back in vogue following the Fukushima disaster in 2011, both China and India are committing more focus on nuclear energy to keep pace with their domestic expansion.

Fossil fuels and renewables simply cannot get the job done without being too pollutive and/or expensive.

There are carbon emission targets to be met too, and building thousands of wind farms is impractical.

Emerging catalysts

BOE is now in position to make its move, in terms of getting its Honeymoon Project progressed through to production, and its share price to reflect the growing value of its operations.

However, BOE is a small mining company and a speculative stock – apply caution to your investment decision, and it’s always a good idea to seek professional advice.

In its most recent announcement BOE increased its Honeymoon Uranium Project Resource by 90% to 53Mlbs U 3 O 8. The current resource model indicates significant potential for future increases through extensional and infill drilling throughout the 15km strike length of Gould’s Dam.

The Goulds Dam and Jasons targets are the key future prospects that have the potential to generate a share price revaluation as and when BOE obtains the all-important geological assessment data.

Planning is underway for resource drilling at the high-priority Jasons region in the Eastern tenements.

With wedding bells fading, this Boss is off on his Honeymoon

The Honeymoon Resource is one of the highest grade uranium projects held by any ASX company and now stands at 52.5Mlbs of U 3 O 8, representing a 330% increase in resources since the project was acquired in December 2015.

BOE has demonstrated an opportunistic streak and some savvy entrepreneurial nous to get its foot in the door in South Australia – the nuclear epicentre of Australia.

For a company worth a meagre $34MN, there’s a lot of spare capacity for a revaluation.

This is the kind of prospective investment that The Next Mining Boom looks for – well placed, undervalued companies that have a good shot at success.

BOE has been transformed into an advanced uranium developer through an astute acquisition of a dormant Resource that’s been largely overlooked given the niche nature of uranium mining.

The Honeymoon mine is currently on care and maintenance, has existing infrastructure and a uranium processing facility which is in excellent condition, and remember...

...$170M has been spent on the site previously.

All it needs is some tender loving care to go on line sometime in the next two years.

As a result of the purchase, BOE has all the necessary Australian permits to mine, process and export uranium, which is something that only three other mining companies currently hold.

This acts as an inherent barrier to entry, protecting BOE’s market share at least for the first five years which are most key in any mining project.

Furthermore, BOE is committed to using the ISL extraction technique which is known for its low operating cost base.

All in all, BOE has bagged itself an advanced uranium project that could be producing high grade uranium for years to come, whilst having many of Honeymoon’s project metrics lining up very nicely already.

With the wedding bells of acquisition now dissipating, this Boss is going on the dream Honeymoon it has always wanted.

And we’ll most certainly be keeping an eye on its progress.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.