ASX Junior with Exclusive Exploration Technology – Drilling Shortly

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

There are dozens of Fraser Range nickel explorers now, all hunting for the next big thing. Add to those the scores of other junior explorers scouring the rest of the country, desperately hoping for a “lucky strike”. The chances of a lucky strike are getting slimmer, because most of the truly epic scale metal deposits in Australia have probably already been discovered... What if a mining company gained control of a breakthrough new technology that allowed them to see beneath the Earth’s crust with unprecedented clarity? It could revolutionise the industry, and take a lot of luck out of the equation. To our pleasant surprise, such a technology does exist. To our even more pleasant surprise, this technology is not controlled by BHP, or Rio, or one of the major multi-billion dollar international mining houses... This potentially game changing technology now sits in the hands of one very lucky $12 million ASX explorer. Not that luck had anything to do with it – in 2013 this junior outsmarted the majors and snapped up exclusive access to the technology via a partnership with the company that invented it. They also acquired rights to a raft of high impact, high probability projects and targets as part of the technology partnership – first rights to projects that were selected, and targets generated by this world-first technology. Some serious exploration is about to get underway... this company is cashed up and planning to drill in every single quarter for the foreseeable future – which should generate plenty of interest from the market. But right now it’s so under the radar, we doubt you’ve ever even heard of it. The Next Mining Boom has been aching to reveal our latest investment:

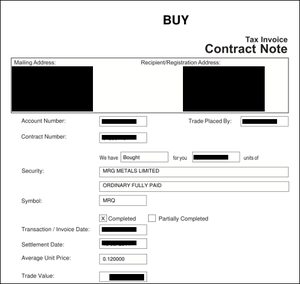

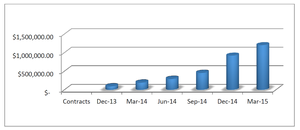

It’s not just the technology we are interested in – MRG Metals (ASX:MRQ) have seriously big deal projects all over Western Australia and Queensland. MRQ had $1.2M cash in the bank at June 30 th 2014, and are expecting more funds to hit the bank account in the next few months from Government Research & Development (R&D) Grants. With the next two drilling campaigns in WA co-funded by the WA government via an Exploration Incentive Scheme, any capital raises in the immediate term are unlikely. It’s very early days in exploration for MRQ, but we have recently invested in the company and will be accompanying their projects with interest. The Next Mining Boom invests in every stock we write about as a long term hold . Mining stocks appear to be somewhat unloved right now – this cannot last. We are buying lots of undervalued stocks like MRQ right now, and we believe an upswing is imminent. We take our positions in our stocks for at least 12 months – for more information please see our Financial Services Guide and Disclosure Policy . Here is our purchase contract for MRQ:

Are you an MRQ investor and want to spread the word?

Get the message out there – make sure everyone knows about MRQ and share this article by clicking the buttons below: [sd_share_article title=”ASX Junior with Exclusive Exploration Technology – Drilling Shortly “] With the help of proprietary in house technology, MRQ have siezed control of a swathe of tenements across our wide brown land:

Out of all MRQ’s projects, we are particularly interested in:

- East Yilgarn – this newly identified greenstone belt may hold just as much wealth as its neighbouring greenstone belts – MRQ will be drilling shortly here;

- Loongana – some Nova style nickel targets in the Fraser Range just waiting to be prodded with a drill bit – this will happen straight after the East Yilgarn drilling;

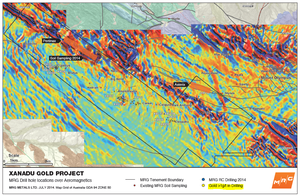

- Xanadu – promising recent drill results have set the stage for further drilling;

- The Queensland IOCG package – tenements in the very profitable and productive Mt Isa region, next door to some mammoth deposits.

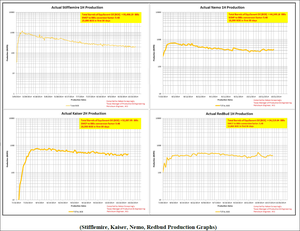

All these projects and more are wrapped up in MRQ’s $12M market cap. To gain access to this technology, MRQ recently acquired a private company “Sasak Resources Australia” – which granted MRQ at least 2 years exclusive use of their in house propeietary technology dubbed “Sasak technology”. This acquisition was completed in exchange for 45 million MRQ shares, plus $150k/year for 2 years access to the technology. MRQ also get first right at tenements generated by Sasak. The Sasak technology uses advanced software, and a combination of GIS mapping, geochemistry, geology and statistics which provides a unique competitive advantage to “see through” the surface, pinpointing drill targets in ways that other technologies can’t. As it is an in house proprietary technology, we can’t go into too much detail. We will explain more a bit later, but for now, it pays to know that several of MRQ’s projects have already been “verified” by this technology. As part of the Sasak deal, MRQ also gained control of the 2000 km 2 of East Yilgarn gold-nickel ground . Targets to be drilled by MRQ this quarter were exposed by this innovative technology. The Sasak predictive modelling indicates that this greenstone belt has the potential to host a brand new 25 million ounce gold province... The region as a whole as already produced more than 260 million ounces. Then there is the Loongana project in the Fraser Range, again acquired from Sasak. The main target zone is 15km long, up to 15km, and magnetic and gravity signatures interpreted by Sasak technology indicate the presence of heavy nickel-copper-platinum mineralisation... MRQ couldn’t help themselves and went and bought even more Fraser Range ground in June ... Wouldn’t you if you knew you had a state-of-the-art technology that had never before been exploited in the search for the next Nova? So that’s already two major mineral provinces that MRQ has infiltrated... The Mt Isa IOCG province in Queensland isn’t safe from this disruptive technology either – MRQ have a host of projects and big targets there too. Another two key MRQ license applications have been granted here in the last few weeks... one of them, EPM19470, is right up against BHP’s behemoth Cannington Mine. MRQ are taking advantage of drilling co-funding grants from both the WA and QLD governments to provide investors with consecutive Sasak-inspired drilling campaigns. In fact, MRQ plan to drill a new Sasak target each and every quarter:

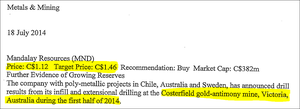

Last but not least is Xanadu – one of their flagship assets at IPO in 2011. Xanadu consists of 14 prospecting licences covering 27 km 2 , just 5 kilometres from Northern Star Resources’ (ASX:NST) Ashburton/Mount Olympus project. Mount Olympus hosts over 1 million ounces of gold... and now, the surrounding underground can be peered into by Sasak’s “X-ray vision”... When MRG bought Sasak, one of the Sasak inventors came on board too – Chris Gregory as a Non-Executive Director. Chris Gregory is a great asset for a junior explorer like MRQ... In addition to co-founding Sasak, he is also the Australian General Manager in Exploration for Canadian listed Mandalay Resources, which is capped at $350 million and have a cash stash of $50 million. Analyst reports arent the only tool we evaluate investments with, but it’s worth noting that analysts at RFC Ambrian recently released a newly bullish price target for Mandalay, based on its ongoing ability to expand resources at its Costerfield gold-antimony project in Victoria:

Source: RFC Ambrian

Before Mandalay and Sasak, Chris Gregory was General Manager of the Southeast Asian arm of Rio Tinto... And he was also directly responsible for the MMG-owned Sepon discovery in Laos, where more than 4 million gold ounces and a shedload of copper have been produced over the last decade:

In case you aren’t aware, Rio Tinto discovered Sepon, with Chris as regional GM, around 20 years ago. It’s also the mine originally responsible for the meteoric rise of Owen Hegarty and Oxiana, who purchased the asset from Rio for $40M. Chris also worked with Rio and BHP in Chile, and was part of the team that made the Escondida Pampa discovery – this was a large extension to the Escondida mine , the world’s largest producing copper mine. If Chris could find and lead the exploration of those sort of mineralised systems before Sasak, imagine what he can do Anno Domini with MRQ!

Our Track Record:

Did you see the Next Small Cap article on Segue Resources (ASX:SEG) ? SEG has been up as high as 200% since we first released our article:

Source: Etrade Australia

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

X-Ray Vision for Mining Exploration

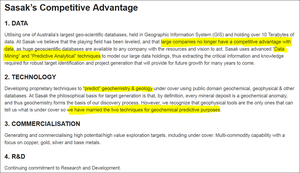

Most of the big, outcropping, easy to find mineral deposits in Australia, and probably the world, have already been found... The next generation of mega-mines will be discovered hiding under shallow cover , with no surface expression. But if you can’t see any signs of mineralisation at surface, how are you supposed to know where to look? That’s where Sasak comes in handy... It is an in-house, proprietary, data-mining technology that offers a unique competitive advantage by seeing through this cover.

And it’s generating big new targets that may just drive the next wave of mineral discoveries:

MRQ are now using this GIS-based technology to data mine and drive exploration. GIS stands for Geographic Information Systems – it’s a digital, computerised method designed to capture, store, analyse, and present geographical data. MRQ now has layers upon layers of GIS data at their fingertips... in addition to one of the largest geochemical databases in Australia – over 10 Terabytes of data. Sasak’s proprietary technology picks up patterns that the human eye cannot see by merely looking at maps or barren surfaces. It then takes dozens of geological data “layers” and compiles it all into something a geologist and geochemist can understand. It’s the very first time this kind of technology has been applied to mineral exploration... MRQ is the fortunate beneficiary, and we are bursting with anticipation given the upcoming drilling planned. MRQ use this technology to select tenements – if a location meets the criteria, MRG will add it to their wish list. If and when one of these tenements becomes available, they make a move, just as they did in June with the new block in the Fraser Range. Alfred Eggo is the mastermind that invented the technology – he is still with Sasak and thus MRQ. He is both a geochemist and a statistician by trade... That’s a hell of a combo if you want to design a world-beating geological exploration tool based on mathematics and precise geochemistry! Here is MRQ’s very sound business strategy:

MRQ definitely has a “unique selling point”... one that’s likely to attract the attention of the majors... if not for takeover then perhaps for farm-in and investment opportunities. The Sasak technology not only saves time and money on exploration, but it makes that exploration much more accurate.

Going Troppo

The acquisition of Sasak also delivered the giant East Yilgarn gold-nickel project into MRQ’s hands – 2000km 2 of unexplored greenstone belt. Greenstone belts host green tinged rocks, plus economical deposits of many minerals – like gold, silver and copper. Gold is most commonly found along the edges of greenstone belts. Now, the Yilgarn Craton, hosts a number of greenstone belts – you can see them on the map below – a vast resource rich province of Western Australia that contains approximately 30% of the world’s known gold reserves. The Yilgarn Craton has produced greater than 260 million ounces of gold, and Sasak predictive modelling indicates that a new greenstone belt to the east also has the potential to host a new 25 million ounce gold province.

Gold Road Resources (ASX:GOR), in similar geological terrain 100km to the southwest, has already discovered over 3 million ounces – as of last week they have a Total Mineral Resource of 3.84 million ounces of gold – and joint ventured part of the project with major Japanese corporation, Sumitomo Metal Mining. When Gold Road were making their big discoveries back in 2011- the market got fairly excited:

The past performance of these products is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. These products, like all other financial products, are subject to market forces and unpredictable events that may adversely affect future performance. As you can see in the chart above, some of the 2011 excitement has been tempered recently. Even so, since a low point in 2013, Gold Road has bounced back and is now capped at around $170 million. Early stage investors in Gold Road would unlikely to be complaining about progress to date. If Gold Road keep boosting their resource size, they may turn out to be sitting on the next Tropicana – AngloGold Ashanti’s 8 million ounce Tropicana deposit which is located nearby. And with drill hits like 653 metres at 1.1g/t gold from just 16 metres, it’s no wonder some think Gold Road may be the next big thing. If Gold Road’s deposit keeps growing, it augers very well for MRQ. A few more of Gold Road’s monster intersections are shown below:

MRQ have only just begun their exploration campaign in this region – there is a lot of drilling to do – but if they can follow in Gold Road’s footsteps we would be very happy indeed. The overall geology of the province is poorly known, since cover up to 30 metres thick covers 90% of the area. That’d be seen as a negative to most exploration companies... but this is the type of situation where MRQ may thrive... Prime geological land, close to existing major deposits, where any surface expressions (outcrops) of big metal deposits have remained hidden from other explorers... Hidden to most, but not to MRQ – the Sasak technology can see through this superficial cover and into the underlying geology. MRQ and Sasak have identified 10 individual gold targets within its 2000km 2 of new greenstone belt. Each one of these targets has a 15-20km strike length, and covers a surface area of 80-120km 2 . And drilling is set to kick off this quarter, co-funded by the WA Government:

![]()

Imagine the market’s fervour when the first ever drilling takes place in this region using prospect selection and drill target refinement using the Sasak technology. Not just any region, but in the world’s most prolific gold bearing region, dotted with multi-million ounce gold deposits. This map is worth repeating:

Surely there is another multi-million ounce deposit here waiting to be discovered... it’s just been hiding undercover.

Our Track Record:

Did you see the Next Oil Rush article on Real Energy (ASX:RLE) ? RLE has been up as high as 40% since we first released our article:

Source: Etrade Australia

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Unfair Advantage in the Fraser Range?

Over at Loongana in the Fraser Range, MRQ have big Nova-style nickel targets ready to be penetrated by a Sasak-pinpointed drill bit. Nova is the massive nickel deposit Sirius uncovered – which is part of a series of discoveries which just seem to be getting bigger in magnitude. MRQ’s Loongana project covers part of an interpreted layered mafic-ultramafic complex buried under cover. MRQ is to test this complex for large scale nickel-copper-platinum mineralisation, which Sasak technology and magnetic imaging has calculated to be a distinct possibility:

MRQ’s main target zone is 15km long and up to 15km wide , covering the core of the complex... Again, younger sediments cover almost 90% percent of the area... but what is a massive challenge for other explorers is a massive opportunity for MRQ, thanks to Sasak technology. Drilling here is likely to take place towards the end of this quarter or early in the next – MRQ are just waiting on final environmental approvals before commencing geochemical sampling. The area has been drilled before, however without the Sasak technogogy pinpointing the targets. Even still, positive results were returned. The next set of drill results should prove very interesting now that the Sasak machine is identifying targets. The area has even been shown to be prospective for IOCG, and the WA government is again chipping in for drilling costs... how nice of them.

Emerging Gold Discovery at Xanadu?

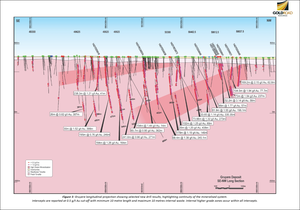

Xanadu covers 14 prospecting licences covering 27km 2 , just 5 kilometres from Northern Star Resources’ (ASX:NST) Mount Olympus project. Mount Olympus hosts a resource of 21.3 million tonnes at 2.4g/t gold for 1.67 million gold ounce. And now, the nearby underground area has been peered into by Sasak’s “X-ray vision”... MRQ’s tenements cover a 12km strike length along the prospective corridor that follows the Nanjilgardy Fault. Using MRQ’s Sasak Technology, and in house and publicly available data, the boffins at MRQ applied their calculations, and identified four priority targets which were recently drilled. The latest batch of drilling results from 22 nd July gave irrefutable proof that the Sasak technology works. The prospects drilled were undercover and invisible with zero outcropping, and had never been drilled – they were blinder than blind targets. Yet the Claudius prospect returned intercepts of 21 metres at 1.22 g/t gold from 40 metres, amongst numerous other strong results. At the Cleopatra target, drilling hit 11 metres at 1.29 g/t gold from 160 metres, and 5 metres at 2.33 g/t gold from 60 metres. Drill hits above 1g/t are shown in the image below:

These early results from first round drilling at Xanadu have already validated MRQ’s system of locating hidden deposits. And 58 assays are still awaited. Results so far will be now be analysed with Sasak’s proprietary techniques to refine additional targets, along with further soil sampling. Plenty more of “price sensitive” news flows to come!

MRQ infiltrates QLD’s IOCG Province

Sasak has internally validated its generative predictive analytical techniques for IOCG deposits, identifying three high potential IOCG targets on open ground within MRQ’s Mount Isa Block. These targets share geological similarities to nearby mega-deposits such the Ernest Henry deposit of 170 million tonnes at 1.7% copper and 0.54% gold. The really big news from QLD is that two new licences have just been officially granted to MRQ – one near the NT border was granted on 17 July, and another, next to BHP’s goliath Cannington zinc-lead-silver mine was granted a few days later :

The locations of the tenements are the orange stars in the below image, you can also see all the mines dotted around the region:

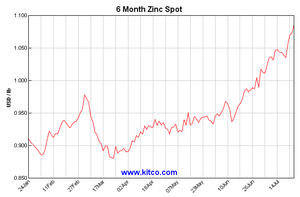

Cannington is now the world’s single largest, and lowest cost, producer of silver and lead – in addition to copious quantities of zinc. In the current metals climate of exploding zinc and lead prices , and strengthening silver prices, do you think this is something the market might be interested in? Check out what zinc has been up to lately:

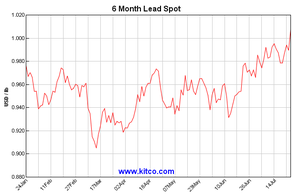

Lead has been following suit:

Given the location of MRQ’s tenement next to BHP’s Cannington, and the metals it may contain, it alone could justify MRQ’s current market cap of $12 million.

Our Track Record:

If you are new to our site, you may not have seen our Next Oil Rush Tip of the Decade – which called Africa Oil Corp (TSX:AOI) – AOI has been up over 600% since we called it!

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Pre Investment Checklist

The Next Mining Boom invests only in resource companies who have strong potential for high returns. However with that potential comes much greater risk. To increase our chances of success we line up its particulars against the pre-investment check-list featured in our book on making money from resource stocks:

We won’t reveal ALL of our check-list – to see that you will just have to read the book. But here are three points from the check-list: What is the track record of management? With Chris Gregory on board, MRQ have every chance of making a major discovery... after all he did discover the deposit responsible for the meteoric rise of Oxiana Resources, while working at Rio Tinto. Sasak, and now MRQ’s Chief Technical Officer, Alfred Eggo, is a geochemist with over 30 years of technical excellence to his name, including 16 years with Rio Tinto, and will be responsible for using their proprietary data mining technology. What assets do the company own? Is the asset base diversified? Not only does MRQ have a suite of major gold, nickel copper and IOCG target spanning across Australia’s biggest mineral provinces, they also control a world first patented technology that makes a big discovery several times more likely. Does the company have a small market cap? Given MRQ’s projects, targets, technology and management credentials, one would expect the company to be capitalised much higher... But due to MRQ being so far under the radar, and in early stage exploration, it’s currently only valued at $12 million.

MRQ planning drilling in every quarter...

MRQ has a veritable plethora of genuine and regular price catalysts in the near term. And given the remarkable mining exploration technology they control, they have a better chance than most of becoming a “catalyst converter” . MRQ will be drilling a new, Sasak- generated target each and every quarter... no months of waiting around for something to happen. With the integration of Sasak technology, MRQ has a point of difference to every other listed and unlisted mineral explorer on the planet. This is the very first time – ever, the world over – that Sasak’s technology has been used to pinpoint drilling targets. And these drilling targets are near world class gargantuan deposits such as Tropicana, Nova-Bollinger, and Cannington. It’s still hard to believe MRQ is still capped at $12 million... And there is only one reason it’s still so cheap – nobody knows about it yet. As soon as more investors cotton on to MRQ, there could be some explosive share price movements...

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.