SVM tagged as a ‘Buy’ as it progresses to graphite production

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. FinFeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

Sovereign Metals Ltd (ASX:SVM) received an endorsement from Bell Potter this morning, when the broker tagged the small cap graphite explorer with a BUY (speculative) recommendation.

Bell Potter initiated coverage on SVM with a 30 cent target price. This is well above the current share price of 10 cents and translates to an expected total return of 200%.

It should be noted here that broker projections and price targets are only estimates and may not be met. Also, share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

Sovereign Metals is looking to develop its unique 100%-owned Malingunde Graphite Project in Malawi with the goal of simple, low cost production to undercut peers.

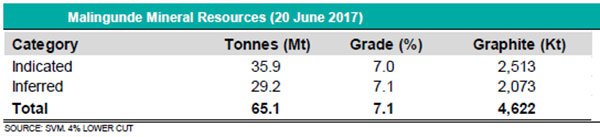

SVM have completed a scoping study on its Malingunde Graphite Project, which indicates the potential for a project to become economically viable.

The key outcomes of the scoping study were low capital expenditure, low operating costs, and a high quality product. It defined a resource base shown to be adequate for 17 years mine life.

Bell Potter found the Malingunde Graphite Project to be “a very attractive one based on a geologically special graphite deposit in Malaw”. It highlighted the natural advantages of the deposit, particularly the very shallow and soft, yet still extremely high grade mineralisation. This, along with its low cost, gives it major mining and processing advantages over its peers.

The company has sector-leading low costs that are underpinned by low strip ratios (low relative amounts of waste material), high grade and the lack of higher cost crushing or grinding of the soft ore.

Bell Potter highlights that the project has development capital expenditure of just US$29 million. This reflects the small scale of the project thanks to high head grades and management’s decision to produce a manageable ~45ktpa of concentrate. The absence of a crushing circuit and the proximity to infrastructure helps keep capital costs low too.

The project’s low capital requirements translate to the fastest payback on capital in the sector and suggest that funding the project should be relatively hassle free. Growing demand for graphite on the back on of the emerging of graphite use in batteries,

SVM is set to be a low cost producer well positioned to get market acceptance ahead of higher cost production from peers.

The broker determined that as a low cost, easily fundable and high quality producer, SVM with its Malingunde graphite project, is extremely well placed to undercut and outstrip other potential peers.

Since completion of the scoping study the company is now getting ready to commence a feasibility study. Newsflow is expected to add value as SVM looks to develop and de-risk the project as it head towards production. Assuming all goes to plan the company could be mining graphite at Malingunde in 2020.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.