AIM Stock Charges Towards Production as Uranium Bulls Gather Steam

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Nuclear power is a critical player on the global energy stage and it looks to be rebounding in popularity, especially amongst investors.

Since President Trump took office, the Global X Uranium ETF, a basket of several big uranium mining stocks has been up nearly 40%. And that’s without Trump uttering a word about his stance on nuclear politics (although he has appointed the pro nuclear Rick Perry as Secretary of Energy).

Several media outlets have been pushing the uranium barrow and it is a sentiment expressed worldwide.

In a Daily Telegraph article in November last year, Berkeley Energia (LSE |ASX:BKY) made the paper with regard to the 500 jobs it hopes to create in a depressed former mining region.

BKY put the shovels to the dirt in August 2016 in Western Spain, near the ancient city of Salamanca, and started work on a £80M uranium mine.

It is a good time to be mining for uranium, especially if you have hold of a mine that will be one of the world’s biggest producers – supplying over four million pounds of uranium concentrate a year, equivalent to approximately 10% of the continent’s total requirement, as BKY do.

A further advantage for BKY, is its expectation that it will come into production just as the market rebounds.

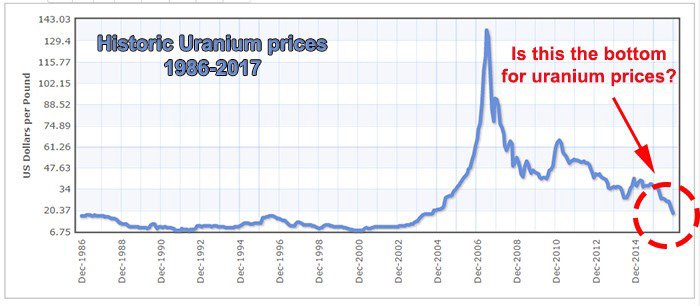

Anyone who follows the uranium price, knows it hit spectacular highs in 2007, with the price increasing some 450% in a matter of months following the flooding of the Cigar Lake Mine in Saskatchewan, which created fears of a short term supply drought.

The boom didn’t last and the industry was dealt a heavier blow after the Fukushima disaster, when the nuclear future seemed abandoned.

Since that fateful day, uranium has been one of the world’s worst performing commodities, but as we alluded to above the price may have bottomed out, which can only mean one thing: a rebound is imminent.

Uranium prices may rebound after downturn , The Bottom for Uranium Stocks is In , Uranium Prices Set to Double by 2018 are just some of the headlines we are now seeing.

So with BKY on course to become the world’s 9 th largest uranium producer, it is really in the gun to meet its objective to become one of the world’s lowest cost producers, reliably supplying the world’s leading utilities with fuel for base load clean energy from the heart of the European Union.

Here’s some of the more recent highlights that are stacking up for this near term uranium producer.

- Off-take agreement concluded with Interalloys for double initial volume at US$43/lb and growing demand from US and Asian utilities

- US$30 million raised from London institutions in an oversubscribed fundraise, making BKY a cashed up, tightly held entity (institutional holding makes up approximately 67% of the register)

- Main equipment for the crushing circuit ordered, other infrastructure development continues to progress

- Major land acquisitions completed ahead of commencement of Salamanca mine construction – leading to additional resource growth down the track?

- The Company has been shortlisted for the UK Stock Market Awards ‘Investor Relations Team of the Year Award’, along with Tesco, Sainsbury’s and Next

That’s a solid achievement and bodes well for BKY’s future, so let’s take a broader look at the story so far and the highlights that drove its last quarter.

Upon release of its current quarterly financial statement, Managing Director, Paul Atherley said the last quarter of 2016 was one of the most significant for Berkeley Energia (LSE | ASX :BKY).

Atherley was referring to the progress made by BKY on the first stages of construction, the signed off-take agreement for US$43.78 per pound of contracted and optional volumes – comparing favourably against the current spot price and the US$30M equity raise.

BKY’s Salamanca mine is being constructed just as uranium prices have begun rising after multi-year lows. As such BKY is receiving growing interest from US and Asian utilities looking to diversify their off-take with a low cost. The fact this producer sits in the heart of the European Union is another bonus.

Investor interest in BKY is further amplified by the company’s intention to bring Salamanca online just as the US and EU utilities will commence re-contracting for medium to long term supply.

With production expected late 2018 and construction now well underway, BKY has a year to ensure that smooth construction becomes solid production, which in turn could lead to a steady rise in the share price as risk in the project delivery diminishes.

Long term investors must be very pleased with BKY’s performance over the last 12 months – BKY is up around 400%.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

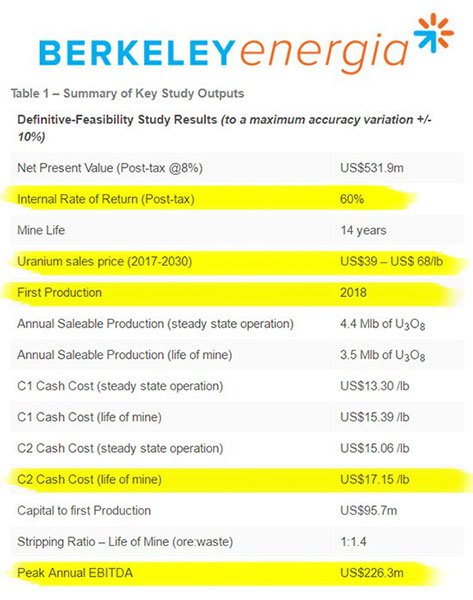

Furthermore, a sturdy Definitive Feasibility Study (DFS) shows BKY can produce uranium at US$13.30/lb, while current prices remain around US$20/lb.

So what exactly does Salamanca have to offer?

The only uranium mine under construction... in the world

Located in Spain, BKY holds the only uranium mine under construction.

We’re not just referring to Europe here, but the world over.

As much of the world turned away from nuclear energy as a power source, BKY has been diligently plotting its course, and now has the location, the sentiment and a unique position in the marketplace to put its production schedule right on track to capitalise on favourable market conditions set to underpin uranium demand/supply.

BKY is constructing its mine with money in the bank and low capital and operating costs compared to any other uranium producer.

Consider that operating costs are expected to peak at US$13.30/lb when compared to the industry average of US$30/lb, and you come to a quick understanding that BKY’s production schedule is very healthy and will enable it to commence production from day one.

This fact alone could put BKY on par with the likes of bigger players such as Cameco, a Canadian producer worth C$5.7 billion which saw its share price rally by more than 40% since the end of October 2016.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

BKY will be hoping for similar traction as it readies its mine for production, reiterating once again that it holds the only uranium mine in the world that is currently under construction at a time when the world is approaching a supply/demand deficit that will be the largest the world has ever seen. Cantor Fitzgerald believe that the uranium price rise will be ‘violent’.

It is also worth noting that the world’s largest uranium producer, Kazatomprom has bucked the trend and cut output by 10%, opening the global market . This prompted analyst Cantor Fitzgerald to say that uranium is likely to reach an inflection point as demand is set to outstrip supply.

Certainly, the market has taken notice of BKY’s progress.

The DFS that proves BKY’s mettle

BKY is making haste to mature into a profitable uranium producer within the coming 18 months, generating a peak annual EBITDA of US$226.3 million in the process and with a DFS and a successful fundraise in the bag, it is now focused on heading towards production.

Below you can see just how strong the DFS results are:

Uranium at the Salamanca mine is confirmed to be close to the surface making deposits easy to access with an open pit mine.

Once in steady state of production, BKY expects to be producing as much as 4.4 million pounds of uranium (1,995 tonnes), making it the 9th largest uranium producer in the world, and the largest in Europe.

The DFS has seen BKY achieve significant interest from offtake parties. The most important agreement has been a signed binding off-take agreement with Interalloys for the sale of the first uranium production from Salamanca.

BKY and Interalloys converted the previously announced Letter of Intent into a binding agreement that included a doubling of annual contracted volumes to a total of two million pounds over a five-year period.

There remains further potential to increase annual volumes as well as extend the contract to a total of three million pounds, while a combination of fixed and market related pricing will apply in order to secure positive margins in the early years of production and ensure the Company remains exposed to potentially higher prices in the future..

An average fixed price of US$43.78 per pound of contracted and optional volumes was agreed between BKY and Interalloys, which compares very favourably to a prevailing spot price, of approximately US$18 per pound at that time. This indicates the market is fully anticipating a rise in uranium prices as BKY moves into production.

BKY is also in discussions with other potential off-takers in relation to contracts with terms similar to those outlined in the Interalloys Agreement, with pricing at or around long term benchmark levels for term contracts. Contracts for sale will be entered into in the ordinary course of business as the company progressively builds its sales book with high quality offtakers.

BKY’s construction phase

In order to hit the ground running, BKY has acquired or leased over 500 hectares of land, which it hopes will shorten its path to production by several months compared to previous estimates.

The acquisition of this land will allow for the completion of the initial infrastructure currently underway and the commencement of construction of the processing plant in the first quarter of 2017 together with construction of a medium voltage substation, reagent storage facilities and buildings.

The company is moving full steam ahead with infrastructure work including re-routing existing roads and power lines as a further step towards construction.

Initial infrastructure development of the Salamanca mine commenced in August 2016 with the re-routing of the existing electrical power line to service the mine and a 5km realignment of an existing road.

The road deviation will be completed in the summer along with development of pedestrian footpaths, secure cattle paths and the installation of a Wi-Fi network for the local villagers as part of BKY’s commitment to improve infrastructure for the local community.

In fact, BKY intends to be highly supportive of the local community as to date it has received over 21,000 applications for the first 200 direct jobs it will create . It has estimated that for this type of business there will be a multiplier of 5.1 indirect jobs for every direct job created, resulting in over 2,750 direct and indirect jobs forecast when the mine is in full production.

A new commercial landscape

As we alluded to earlier, BKY will be coming into production just as macro-economic factors are ready to place uranium stocks into favour.

Both the US and EU will be looking to renegotiate 80% of long term supplies over the next five years, but it is China that could be the ace in the pack.

China is on course to boost its nuclear power capacity by more than 70% by 2020.

That’s an expansion totalling 30 nuclear power reactors within the coming 3 years – an astonishing rate of growth that few economies could ever aspire to.

So the question on everybody’s lips is...

According to finfeed.com , China was seen as a major hold out as little as three or four years ago, as the world turned away from fossil fuels, driven by concern over climate change.

Since then China has changed its tune – not because of massive concern over climate change, but mostly because coastal and more populous cities became hubs of smog from coal-powered plants. China wants to clean up its air – and nuclear power plants can help.

Japan has also restarted its nuclear program as it attempts to bring back atomic power. In Japan, nine reactors should be in operation by the end of this year.

A third Asian nation, India, also plans to expand its nuclear power capacity by around 30% by 2020.

So the world is turning favourably towards nuclear and it could be given a further boost by the new US president.

The Trump factor

While the enigmatic Donald Trump hasn’t explicitly outlined his nuclear policy, it does look favourable.

He has hired former presidential rival Rick Perry as Energy Secretary , a man who is openly pro-nuclear, which will serve Trump’s goal to expand the nuclear capability of the US.

All in all it seems the nuclear industry is turning the corner towards improving its slice of the global energy production pie.

One of the more bullish analyst estimates regarding the future of uranium comes from Willem Middelkoop, the founder of Aerdenhout, a Netherlands-based Commodity Discovery Fund that returned 70% for its investors in 2016. Middelkoop said he expects the spot price to return to at least $US30 in 2017 and rise substantially in the longer term beyond US$100/lb because of the pipeline of nuclear-power projects being conducted globally.

Here is a historic look at uranium prices. As you can see, uranium prices can swing to extremes due to uranium’s unique market forces.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Uranium prices have traded as high as US$137/lb. and are currently trading close to US$20/lb.

Several analysts think these low levels aren’t sustainable given the expected increase in uranium demand, power consumption, population growth and international conflict deterrents.

With all these factors in play, BKY is well set up to take advantage once it brings its production online.

From Carbon Past to Nuclear Future

The world is experiencing a nuclear renaissance, with several superpowers now looking to nuclear facilities as not only economy boosters, but also a clean energy alternative.

So with current market forces in play and the binding offtake agreements ... this appears to be one healthy looking company.

BKY has doubled its initial offtake deal at US$43/lb while its production costs will remain at US$13.30/lb, which bears close to surface deposits that can be mined through an open-pit mine (the most cost-effective method of uranium mining).

BKY is pushing hard to spearhead the nuclear renaissance, currently being led by BRIC countries China, India and Russia. As we hinted above, even the Americans are coming back around to the idea of nuclear power, inspired by the soon-to-be US President, Donald Trump.

Low demand and high supply means that uranium prices have continued to fall in recent years. But now, the combination of existing supply contracts coming to an end and more reactors coming on stream, should ensure a much brighter future for speculative uranium investors...

...and BKY is on course to take a prime position as the largest uranium producer in Europe and the 9 th largest globally by as early as 2018.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.